JLL Capital Markets, Chicago, arranged $39 million in acquisition financing for 333 North Street, a warehouse and distribution facility totaling 221,448 square feet in Teterboro, N.J.

Tag: Dealmaker

Dealmaker: JLL Arranges $39M for New Jersey Warehouse Acquisition

JLL Capital Markets, Chicago, arranged $39 million in acquisition financing for 333 North Street, a warehouse and distribution facility totaling 221,448 square feet in Teterboro, N.J.

Dealmaker: Gantry Secures $54M for Seattle Multifamily Property

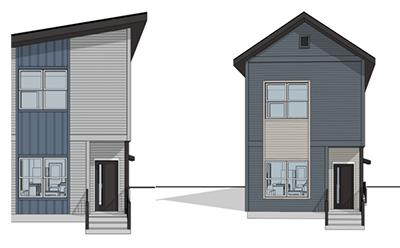

Gantry, San Francisco, secured $53.5 million in permanent financing for 237-unit Cypress Apartments in Seattle’s Yesler Terrace community.

Dealmaker: Red Oak Capital Holdings Provides $8.3M for Illinois Office Park

Red Oak Capital Holdings, Grand Rapids, Mich, provided $8.3 million to complete refurbishment and re-tenanting an office property in Hoffman Estates, Ill.

Dealmaker: BWE Secures $35M in Financing for Washington Retail Center

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed a $35 million loan to refinance a major retail center in the Pacific Northwest.

Dealmaker: IPA Negotiates $54M Los Angeles Multifamily Asset Sale

Institutional Property Advisors, Calabasas, Calif., sold 205-unit Los Angeles multifamily community Haven Warner Center for $54 million, or $263,415 per unit.

Dealmaker: Walker & Dunlop Arranges $94M for New York Logistics Center

Walker & Dunlop, Bethesda, Md., arranged $94 million in construction financing for College Point Logistics Center, a Class A logistics warehouse development in College Point, Queens, N.Y.

Dealmaker: Newmark Arranges $248M for The Biltmore in New York

Newmark, New York, arranged $248 million to refinance The Biltmore, a 464-unit apartment building in Manhattan’s Midtown West submarket.

Dealmaker: Dwight Capital and Dwight Mortgage Trust Finance $118M

Dwight Capital, New York, and affiliate Dwight Mortgage Trust closed $118.2 million for multifamily properties in Georgia and New Jersey.

Dealmaker: George Smith Partners Arranges $30M

George Smith Partners, Los Angeles, secured $29.6 million for properties in North Carolina.