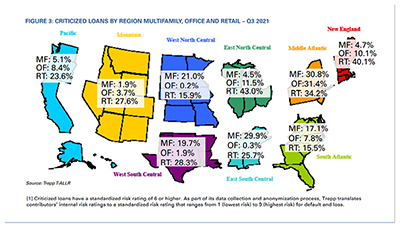

Trepp LLC, New York, said bank commercial real estate originations rebounded in the third quarter, while delinquencies continue to trend downward after increasing modestly in 2020.

Tag: CRE Delinquency Rate

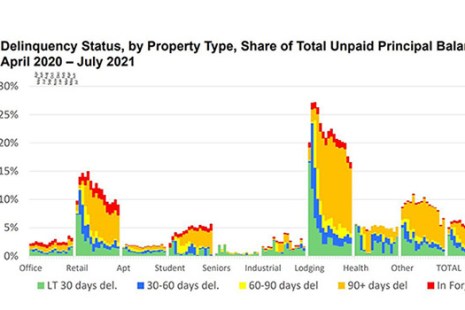

Commercial and Multifamily Mortgage Delinquencies Declined in July

Delinquency rates for mortgages backed by commercial and multifamily properties declined in July, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

MBA: 1Q Commercial, Multifamily Mortgage Delinquencies Remain Low

Commercial and multifamily mortgage delinquencies remained low at the end of the first quarter, the Mortgage Bankers Association said this morning in its first quarter Commercial/Multifamily Delinquency Report.