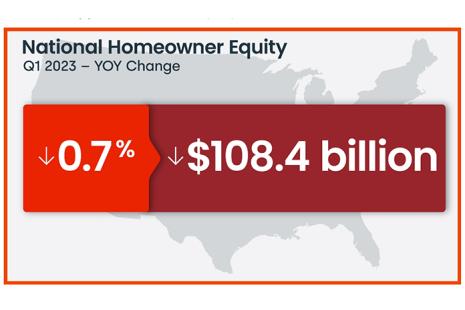

U.S. homeowners with mortgages saw their home equity decrease by 0.7% year-over-year–an average loss of $5,400 per borrower–according to CoreLogic, Irvine, Calif.

Tag: CoreLogic

CoreLogic Reports Borrowers See First Annual Home Equity Losses Since 2012

U.S. homeowners with mortgages saw their home equity decrease by 0.7% year-over-year–an average loss of $5,400 per borrower–according to CoreLogic, Irvine, Calif.

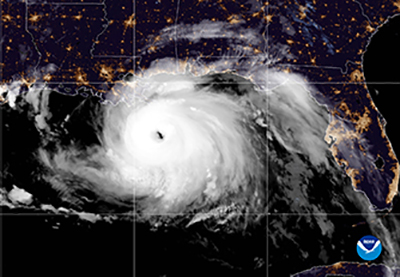

CoreLogic Says 33M Homes at Risk in 2023 Hurricane Season

CoreLogic, Irvine, Calif., reported 33 million U.S. properties are at risk of hurricane-force wind damage, with reconstruction cost value of $11.6 trillion, as the 2023 hurricane season kicks off.

CoreLogic Says 33M Homes at Risk in 2023 Hurricane Season

CoreLogic, Irvine, Calif., reported 33 million U.S. properties are at risk of hurricane-force wind damage, with reconstruction cost value of $11.6 trillion, as the 2023 hurricane season kicks off.

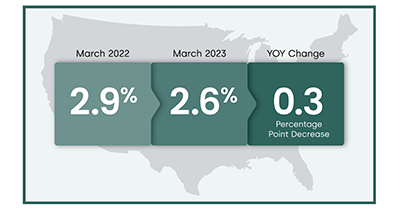

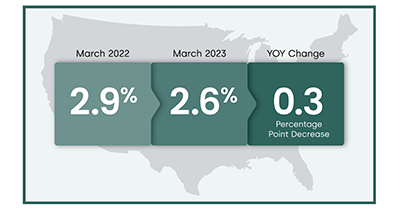

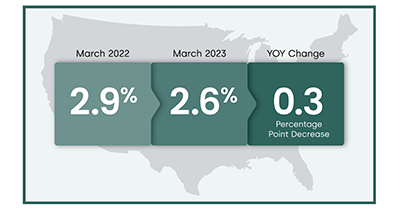

March Mortgage Delinquency Rate Falls to Record Low, CoreLogic Finds

CoreLogic, Irvine, Calif., said just 2.6% of mortgages in the United States were in a stage of delinquency in March, a new low.

March Mortgage Delinquency Rate Falls to Record Low, CoreLogic Finds

CoreLogic, Irvine, Calif., said just 2.6% of mortgages in the United States were in a stage of delinquency in March, a new low.

March Mortgage Delinquency Rate Falls to Record Low, CoreLogic Finds

CoreLogic, Irvine, Calif., said just 2.6% of mortgages in the United States were in a stage of delinquency in March, a new low.

CoreLogic: March Single-Family Rent Growth Slides

CoreLogic, Irvine, Calif., said annual single-family rent price growth wound down to 4.3% in March, marking nearly a year of decelerating gains.

Industry Briefs May 4, 2023: Peak Residential Lending Partners with LenderLogix

LenderLogix, Buffalo, N.Y., announced Peak Residential Lending implemented its application suite – LiteSpeed, QuickQual and Fee Chaser – into its existing tech stack to power a digital borrower experience.

CoreLogic: 20M Houses at High Risk from Severe Convective Storms

Twenty million single-family homes are at high risk from severe convective storms, reported CoreLogic, Irvine, Calif.