CoreLogic, Irvine, Calif., found that U.S. homeowners with mortgages saw equity increase by $425 billion since Q3 2023—a gain of 2.5% year-over-year.

Tag: CoreLogic Home Equity Report

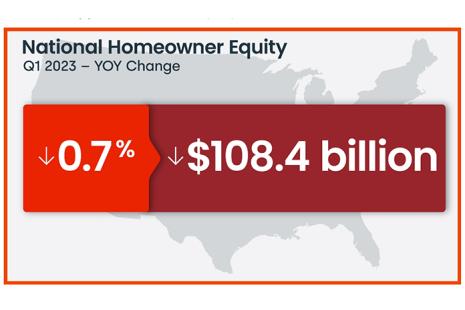

CoreLogic Reports Borrowers See First Annual Home Equity Losses Since 2012

U.S. homeowners with mortgages saw their home equity decrease by 0.7% year-over-year–an average loss of $5,400 per borrower–according to CoreLogic, Irvine, Calif.

MBA Home For All Pledge Partner: CoreLogic

(One in a series of profiles of MBA member companies that have signed the MBA Home For All Pledge, an initiative to promote inclusion in housing.)

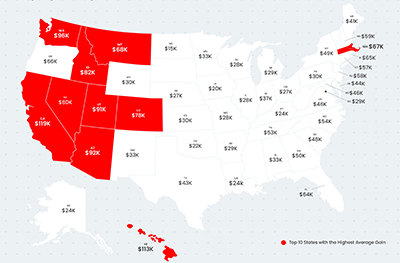

CoreLogic: Homeowners in Negative Equity at Lowest Level in 12 Years

CoreLogic, Irvine, Calif., said just 2.1% of U.S. homeowners with a mortgage were underwater as of the fourth quarter, the lowest level since 2010, as borrowers gained more than $3.2 trillion in equity in 2021.

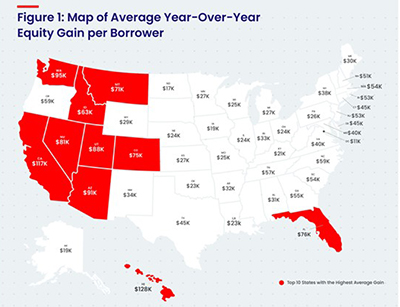

CoreLogic: Homeowners Gained $3.2 Trillion in Equity in Q3

CoreLogic, Irvine, Calif., said homeowners with mortgages (which account for 63% of all properties) saw their equity increase by 31.1% year over year in the third quarter, representing a collective equity gain of more $3.2 trillion and an average gain of $56,700 per borrower.

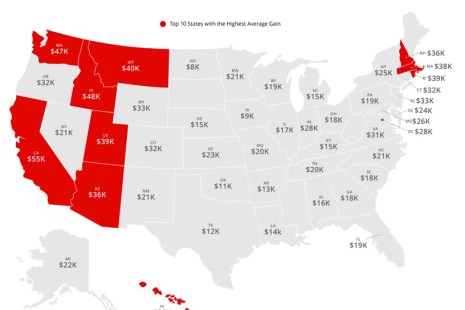

Home Equity Continues to Soar: Homeowners Gained $1.5 Trillion in 2020

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 16.2% year over year, representing a collective equity gain of more than $1.5 trillion, and an average gain of $26,300 per homeowner, from a year ago.