Market dynamics are putting pressure on U.S. housing, Cotality Chief Economist Selma Hepp writes.

Tag: CoreLogic

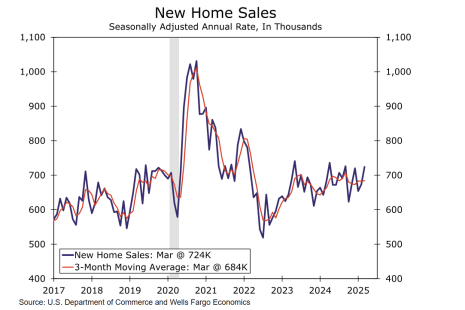

New Home Sales Jump in March

New home sales jumped 7.4% in March compared to February, the Census Bureau and HUD reported Wednesday.

CoreLogic: Average Homeowner With Mortgage Gained $4,100 in Equity in 2024

CoreLogic, Irvine, Calif., released its Homeowner Equity Report for the fourth quarter of 2024, finding that nationwide, borrower equity increased by $281.9 billion. That’s an increase of 1.7% year-over-year.

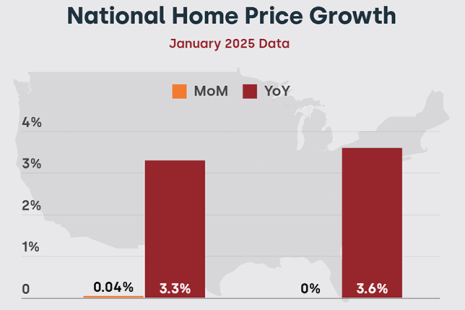

CoreLogic Reports Largely Flat Home Price Growth in January

U.S. home price growth was largely flat in January at 3.3% year over year, according to CoreLogic, Irvine, Calif.

CoreLogic: U.S. Overall Delinquency Rate at 3.1% in December

CoreLogic, Irvine, Calif., reported that the U.S. overall delinquency rate was flat year-over-year, but dropped slightly from November.

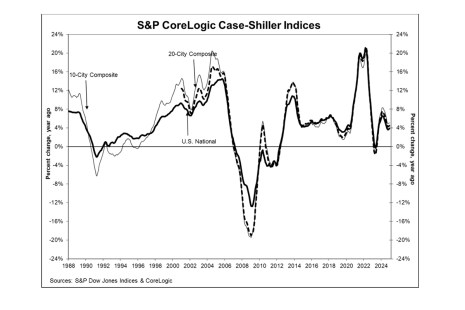

S&P CoreLogic Case-Shiller Index Up 3.9% in December

The December S&P CoreLogic Case-Shiller Indices reported home prices were up 3.9% annually, a slight increase from 3.7% the previous month.

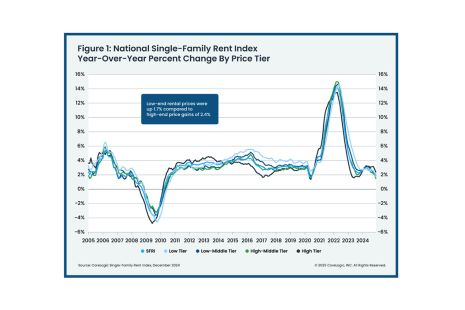

CoreLogic: Annual Single-Family Rent Growth Remains Below 2% in December

Single-family rent prices increased 1.8% year over year in December, up slightly from the previous month’s 1.5%–which had marked a 14-year low for rent growth–according to CoreLogic, Irvine, Calif.

CoreLogic: Single-Family Rent Growth Sees Lowest Annual Increase in 14 Years

CoreLogic, Irvine, Calif., found that single-family rent growth slowed to 1.5% year-over-year. That’s the lowest annual increase in more than 14 years.

MISMO Honors Annual Award Recipients at 2025 Winter Summit

MISMO®, the real estate finance industry’s standards organization, announced the recipients of its MISMO Awards program during a ceremony held at its 2025 Winter Summit.

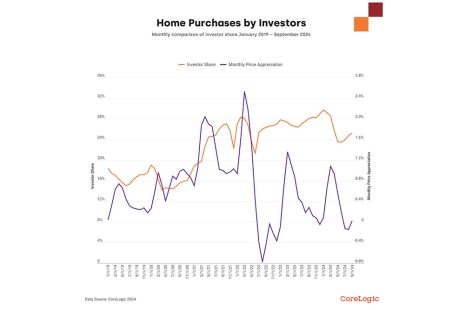

CoreLogic: Investor Share Likely to Remain Roughly Quarter of Total Sales

CoreLogic, Irvine, Calif., released its report on Q3 2024 investor activity on home purchases, finding a small uptick from mid-year numbers.