Orest Tomaselli is President of the Condominium and Cooperative Review Division of CondoTek, Philadelphia, and owner of Strategic Inspections, a national reserve study provider.

Tag: Compliance

Orest Tomaselli of CondoTek on Condo/Co-op Compliance

Orest Tomaselli is President of the Condominium and Cooperative Review Division of CondoTek, Philadelphia, and owner of Strategic Inspections, a national reserve study provider.

Survey Details Lenders’ ‘Substantial’ Risk, Compliance Concerns

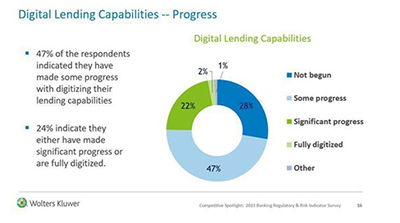

Regulatory compliance and risk concerns remain elevated in a number of key areas for U.S. banks and credit unions, according to results of Wolters Kluwer’s 2021 Regulatory & Risk Management Indicator survey.

Andrew Peters and Sonny Abbasi of Lenderworks: Growing Your Business and Staying Compliant in a Changing Landscape

The likelihood of more aggressive federal enforcement is of special concern to smaller, growing mortgage lenders.

Andrew Peters and Sonny Abbasi of Lenderworks: Growing Your Business and Staying Compliant in a Changing Landscape

The likelihood of more aggressive federal enforcement is of special concern to smaller, growing mortgage lenders.

Joe Puthur of Mortgage Coach: Fair Lending Compliance is a Competitive Advantage

Strengthening mortgage accessibility industry-wide is not a burden, but an opportunity that should be embraced. Every qualified loan is good business and new affordability goals and programs instantly broaden the marketplace of eligible buyers.

Andrew Peters and Sonny Abbasi of Lenderworks: Growing Your Business and Staying Compliant in a Changing Landscape

The likelihood of more aggressive federal enforcement is of special concern to smaller, growing mortgage lenders.

Andrew Peters and Sonny Abbasi of Lenderworks: Growing Your Business and Staying Compliant in a Changing Landscape

The likelihood of more aggressive federal enforcement is of special concern to smaller, growing mortgage lenders.

Joe Puthur of Mortgage Coach: Fair Lending Compliance is a Competitive Advantage

Strengthening mortgage accessibility industry-wide is not a burden, but an opportunity that should be embraced. Every qualified loan is good business and new affordability goals and programs instantly broaden the marketplace of eligible buyers.

Joe Puthur of Mortgage Coach: Fair Lending Compliance is a Competitive Advantage

Strengthening mortgage accessibility industry-wide is not a burden, but an opportunity that should be embraced. Every qualified loan is good business and new affordability goals and programs instantly broaden the marketplace of eligible buyers.