With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

Tag: Commercial Mortgage-Backed Securities

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

MBA: January Commercial, Multifamily Mortgage Delinquencies Decrease

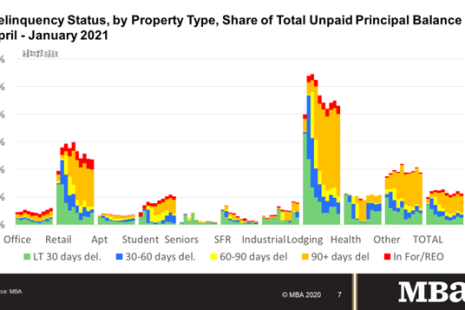

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in January, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

The CMBS Market During the Pandemic: Q&A with Dechert’s Richard Jones

MBA NewsLink interviewed Dechert Partner Richard Jones. He focuses his practice on sophisticated capital markets and mortgage finance transactions. He leads Dechert’s commercial mortgage-back securities team and serves as co-chair of the firm’s global finance group.

The CMBS Market During the Pandemic: Q&A with Dechert’s Richard Jones

MBA NewsLink interviewed Dechert Partner Richard Jones. He focuses his practice on sophisticated capital markets and mortgage finance transactions. He leads Dechert’s commercial mortgage-back securities team and serves as co-chair of the firm’s global finance group.

Stacey Berger of Midland Loan Services on Servicing Technology

MBA NewsLink recently interviewed Stacey M. Berger, Executive Vice President of Midland Loan Services, Overland Park, Kan.

The CMBS Market During the Pandemic: Q&A with Dechert’s Richard Jones

MBA NewsLink interviewed Dechert Partner Richard Jones. He focuses his practice on sophisticated capital markets and mortgage finance transactions. He leads Dechert’s commercial mortgage-back securities team and serves as co-chair of the firm’s global finance group.

Stacey Berger of Midland Loan Services on Servicing Technology

MBA NewsLink recently interviewed Stacey M. Berger, Executive Vice President of Midland Loan Services, Overland Park, Kan.

Stacey Berger of Midland Loan Services on Servicing Technology

MBA NewsLink recently interviewed Stacey M. Berger, Executive Vice President of Midland Loan Services, Overland Park, Kan.

Stacey Berger of Midland Loan Services on Servicing Technology

MBA NewsLink recently interviewed Stacey M. Berger, Executive Vice President of Midland Loan Services, Overland Park, Kan.