Kroll Bond Rating Agency, New York, just released its CMBS 2023 Sector Outlook, which looks at key credit trends from 2022 and forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their insights on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2023.

Tag: Commercial Mortgage-Backed Securities

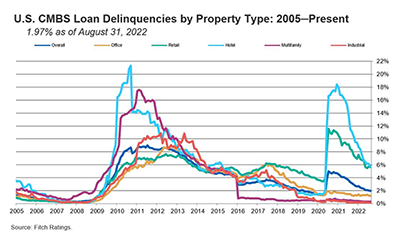

CMBS Loan Delinquency Rate Drops Below 2%

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate fell eight basis points in August to 1.97% due to continued strong resolutions and fewer new delinquencies.

Fitch: Retail Resolutions Drive May U.S. CMBS Loan Delinquency Rate Lower

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell by 22 basis points to 2.10% in May, amid strong retail resolution volume and robust new issuance.

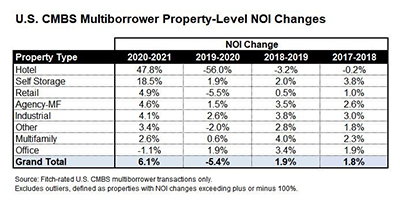

Fitch: CMBS Properties See NOI Recovery

Fitch Ratings, New York, reported property-level net operating income for commercial mortgage-backed securities loans rebounded 6.1 percent on average in 2021.

Q/A: Marcy Thomas, CCMS, of Grandbridge Real Estate Capital

MBA NewsLink interviewed Marcy Thomas, Vice President and Portfolio Loan Manager with Grandbridge Real Estate Capital LLC, about CMBS servicing, DEI, the upcoming Commercial/Multifamily Finance Servicing and Technology Conference and what the CCMS designation means to her.

Q/A: Marcy Thomas, CCMS, of Grandbridge Real Estate Capital

MBA NewsLink interviewed Marcy Thomas, Vice President and Portfolio Loan Manager with Grandbridge Real Estate Capital LLC, about CMBS servicing, DEI, the upcoming Commercial/Multifamily Finance Servicing and Technology Conference and what the CCMS designation means to her.

CMBS Delinquency Rate Maintains Downward Trajectory

The commercial mortgage-backed securities delinquency rate fell 10 basis points during March to 2.38 percent, driven by robust new issuance and few new delinquencies, reported Fitch Ratings, New York.

CREF22: As Issuance Rebounds, Securitization Products Adapt

SAN DIEGO–Commercial mortgage-backed securities are evolving as issuance bounces back, analysts said here at the 2022 MBA Commercial/Multifamily Finance Convention and Expo.

CREF22: As Issuance Rebounds, Securitization Products Adapt

SAN DIEGO–Commercial mortgage-backed securities are evolving as issuance bounces back, analysts said here at the 2022 MBA Commercial/Multifamily Finance Convention and Expo.

KBRA Analysts Look to 2022 Commercial Mortgage-Backed Securities Sector

Kroll Bond Rating Agency, New York, just released its 2022 Sector Outlook—CMBS: Full Steam Ahead report. MBA NewsLink interviewed KBRA’s Larry Kay and Patrick McQuinn to get their insights on the current lending environment and property fundamentals as well as factors that may affect property performance in 2022.