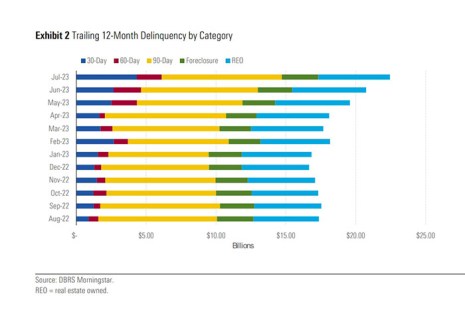

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.

Tag: Commercial Mortgage-Backed Securities

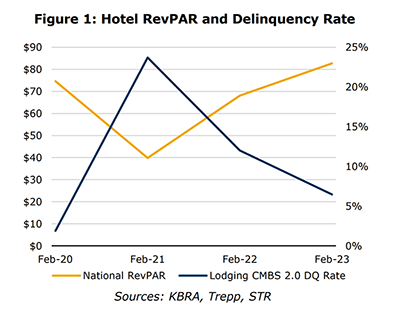

KBRA: Lodging Loan Performance Clouded by Upper-Upscale Chains

U.S. hotels have performed well overall since the pandemic, but upscale properties report higher commercial mortgage-backed securities delinquencies than more modest hotels, reported KBRA, New York.

MBA Letter Addresses Risks to Proposed SEC Rule on Securitizations

The Mortgage Bankers Association, in a Mar. 27 letter to the Securities and Exchange Commission, said a proposed rule to curb certain material conflicts of interest in securitizations is flawed and would present risks to that market.

MBA Letter Addresses Risks to Proposed SEC Rule on Securitizations

The Mortgage Bankers Association, in a Mar. 27 letter to the Securities and Exchange Commission, said a proposed rule to curb certain material conflicts of interest in securitizations is flawed and would present risks to that market.

January CMBS Delinquency Rate Falls Below 3%

Trepp, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 10 basis points in January to 2.94%

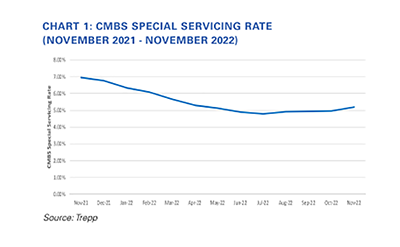

CMBS Special Servicing Rate Rises Again

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased in November for the fourth consecutive month.

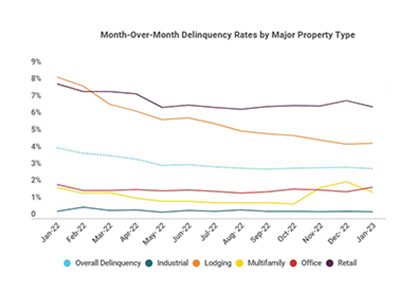

CMBS Sector Outlook: Continued Uncertainty Going into 2023

Kroll Bond Rating Agency, New York, just released its CMBS 2023 Sector Outlook, which looks at key credit trends from 2022 and forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their insights on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2023.

CMBS Sector Outlook: Continued Uncertainty Going into 2023

Kroll Bond Rating Agency, New York, just released its CMBS 2023 Sector Outlook, which looks at key credit trends from 2022 and forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their insights on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2023.

CMBS Sector Outlook: Continued Uncertainty Going into 2023

Kroll Bond Rating Agency, New York, just released its CMBS 2023 Sector Outlook, which looks at key credit trends from 2022 and forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their insights on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2023.

CMBS Sector Outlook: Continued Uncertainty Going into 2023

Kroll Bond Rating Agency, New York, just released its CMBS 2023 Sector Outlook, which looks at key credit trends from 2022 and forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their insights on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2023.