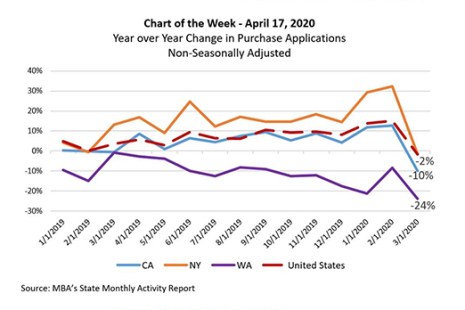

According to data from MBA’s State Monthly Activity Report (SMAR), purchase applications grew for 14 consecutive months until the impacts of COVID-19 slowed activity to a 2 percent decline in March. Most of the decline was likely in the last two weeks of the month, when many states enacted restrictions on non-essential business and social activity.

Tag: California

MBA Chart of the Week: Year over Year Change in Purchase Applications

According to data from MBA’s State Monthly Activity Report (SMAR), purchase applications grew for 14 consecutive months until the impacts of COVID-19 slowed activity to a 2 percent decline in March. Most of the decline was likely in the last two weeks of the month, when many states enacted restrictions on non-essential business and social activity.

‘Million-Dollar City’ Club Grows, But New Entrants Running Dry

Zillow, Seattle, said 11 cities are expected to join the “Million Dollar City” list in 2020—where the typical home value is at least $1 million—but five cities are likely to fall out, with few new entrants expected in coming years.

Forecast: Hottest 2020 Housing Markets in South; California to See Cooldown

Last week, we brought you a story about which U.S. housing markets changed the most over the past decade. Today, we present predictions for 2020’s hottest housing markets, courtesy of Zillow, Seattle.

California Wildfires Put $2 Trillion in Housing at Risk

The winds have died down, somewhat, in California, and the past week’s wildfires are ebbing. But two reports suggest after the totals are tallied up, as much as $2 trillion in housing in four heavily populated counties are at serious risk.

MBA Advocacy Update

This past Monday, President Trump announced that he intends to nominate Federal Housing Administration (FHA) Commissioner Brian Montgomery to be the next Deputy Secretary of the U.S. Department of Housing and Urban Development (HUD). Also, President Trump signed two Executive Orders on regulatory guidance issued by federal agencies. And the Treasury Department issued proposed rules to help ease the transition from the London Interbank Offered Rate (LIBOR) to other reference rates.