Dwight Capital, New York, closed a $59.9 million HUD 223(f) refinance for an apartment community in Davis, Calif.

Tag: California

Dealmaker: Calmwater Capital Funds $21M for California Acquisition

Calmwater Capital, El Segundo, Calif., announced it provided Rhino Investment Group with $20.86 million in short-term, first mortgage debt for its acquisition of a grocery-anchored retail center in Cathedral City, Calif.

ATTOM IDs Areas With Highest Concentration of ‘At-Risk’ Markets

ATTOM, Irvine, Calif., released a Special Housing Risk Report, highlighting that California, New Jersey/New York and Illinois are the areas with the most at-risk housing markets in the country, meaning they are more vulnerable to declines based on home affordability, underwater mortgages and other metrics.

Dealmaker: Colliers Brokers Sale of Historic Oakland Building

Colliers, Toronto, brokered the sale of a historic Young Women’s Christian Association building for $22.5 million in downtown Oakland, Calif.

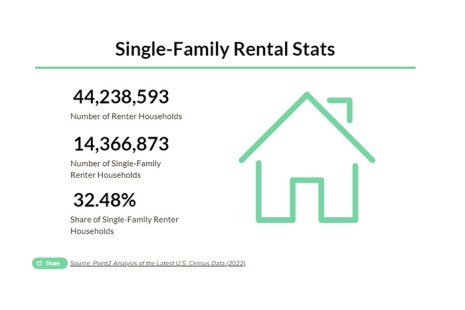

Point2: Amid Build-to-Rent Boom, California Sees Most Luxury Options

Point2, Saskatoon, Saskatchewan, released an analysis finding that five of the top 10 cities with the highest shares of luxury houses for rent are in California

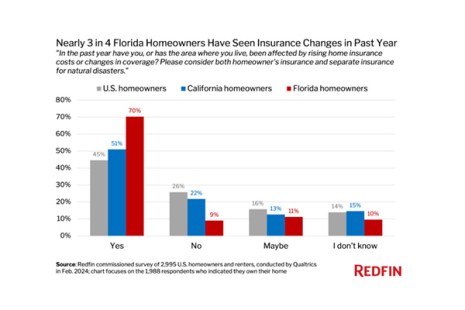

Redfin: Florida, California Homeowners See More Insurance Changes

Redfin, Seattle, recently reported 70.3% of Florida homeowners and 51% of California homeowners say they or the area they live in have been affected by rising home insurance costs or changes to coverage over the past year.

Dealmaker: Gantry Secures $7.15M Loan for California Winery

Gantry, San Francisco, announced a $7.15 million construction-to-permanent loan for the build-to-suit development of facilities for Auteur Wines.

Dealmaker: Newmark Arranges $154M Office Building Sale in Los Angeles

Newmark, New York, arranged the sale of a 1.1 million-square-foot office building in downtown Los Angeles for $153.5 million to Carolwood Equities.

MBA Advocacy Update Sept. 25: FDIC Chairman Gruenberg Calls for Enhanced Prudential Standards and Increased Nonbank Reporting in Speech

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update Sept. 25: FDIC Chairman Gruenberg Calls for Enhanced Prudential Standards and Increased Nonbank Reporting in Speech

This week’s top legislative and policy news from the Mortgage Bankers Association.