Today’s communications systems make it possible for mortgage servicers to take back control with business users at the helm over the authoring and management process through the point of sending it to the printer or digital systems that deliver or mail the communication. This gives servicers the opportunity to lower costs, reduce operational risk, and set up for a thriving digital future.

Tag: Borrower Communication

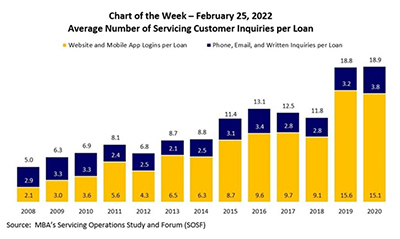

MBA Chart of the Week: Servicing Customer Inquiries Per Loan

In this week’s MBA Chart of the Week, we focus on borrower communications, specifically the average number of annual servicing customer inquiries per loan. MBA has tracked this data through its Servicing Operations Study and Forum since 2008.