Last Friday, FHFA announced the removal of the GSEs’ 50-basis-point adverse market fee in response to both industry advocacy and improved market conditions.

Tag: Bill Killmer

MBA Advocacy Update July 12, 2021

MBA submitted recommendations to FHFA last week with respect to the GSEs’ policies addressing eligibility of condominium projects that include short-term rentals. Also last week, Ginnie Mae announced it will continue current measures that allow for the electronic execution and transmission of form HUD 11711A (Release of Security Interest) and form HUD 11711B (Certification and Agreement).

MBA Advocacy Update July 12, 2021

MBA submitted recommendations to FHFA last week with respect to the GSEs’ policies addressing eligibility of condominium projects that include short-term rentals. Also last week, Ginnie Mae announced it will continue current measures that allow for the electronic execution and transmission of form HUD 11711A (Release of Security Interest) and form HUD 11711B (Certification and Agreement).

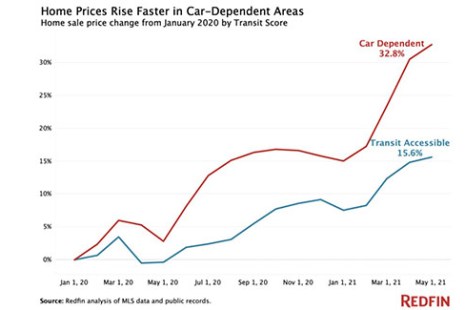

Home Prices Rose Twice as Fast in Car-Dependent Neighborhoods as Transit-Accessible Areas

Home prices in car-dependent areas are up 33% since before the pandemic versus 16% for transit-accessible neighborhoods, according to a new report from Redfin, Seattle, reflecting the rise in remote work and the declining importance of proximity to public transportation.

MBA Letter Urges Support of HUD Priorities in Fiscal 2022 Appropriations Bill

Ahead of a scheduled vote next week, the Mortgage Bankers Association asked the House Appropriations Committee to support key fiscal year 2022 appropriations proposed to HUD, FHA and Ginnie Mae.

MBA Advocacy Update July 6 2021

The CFPB released its final rule amending select requirements of Regulation X to assist borrowers impacted by COVID-19. Also last week, MBA President and CEO Bob Broeksmit, CMB, sent a letter to the leaders of the National Governors Association and CSBS to ask for their assistance in addressing the challenges MBA member companies face as they attempt to reopen their offices.

MBA Advocacy Update July 6 2021

The CFPB released its final rule amending select requirements of Regulation X to assist borrowers impacted by COVID-19. Also last week, MBA President and CEO Bob Broeksmit, CMB, sent a letter to the leaders of the National Governors Association and CSBS to ask for their assistance in addressing the challenges MBA member companies face as they attempt to reopen their offices.

MBA, Trade Groups Urge Fairness on ‘Carried Interest;’ Support for ‘INVEST in America’ Bill

The Mortgage Bankers Association and more than a dozen industry trade groups warned Congress that legislation and a separate Biden Administration proposal to change longstanding tax laws on “carried interest” could have damaging implications for Americans who use partnerships to develop, own and operate real estate.

MBA, Trade Groups Urge Fairness on ‘Carried Interest;’ Support for ‘INVEST in America’ Bill

The Mortgage Bankers Association and more than a dozen industry trade groups warned Congress that legislation and a separate Biden Administration proposal to change longstanding tax laws on “carried interest” could have damaging implications for Americans who use partnerships to develop, own and operate real estate.

MBA Advocacy Update June 28 2021

On Wednesday, President Biden replaced FHFA Director Mark Calabria with Sandra L. Thompson, naming her Acting Director effective immediately. On Thursday, President Biden announced his intention to nominate Julia Gordon as the next FHA Commissioner.