Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.

Tag: ACES Risk Management

Sponsored Content from ACES Quality Management: How QC Drives Profit Preservation

Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.

Sponsored Content from ACES Quality Management: How QC Drives Profit Preservation

Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.

Sponsored Content from ACES Quality Management: How QC Drives Profit Preservation

Amidst changing QC requirements and increasing repurchase risk, lenders must invest in automation to drive efficiency and protect profits.

Industry Briefs Sept. 18, 2020

ACES Risk Management (ARMCO), Denver, a provider of management and control software for the financial services industry, completed its rebranding effort to align the company’s image with its expanded focus on quality and risk management for banks and credit unions, as well as independent mortgage lenders.

Housing Report Roundup

Welcome to the Friday Housing Report Roundup. Click on the link to see what’s happening.

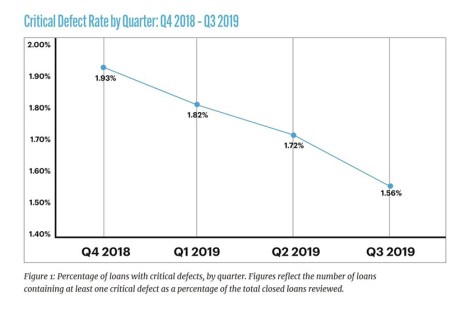

ARMCO: Year over Year Trends Show ‘Marked Improvement’ in Critical Defect Rates

ACES Risk Management, Denver, released its quarterly ARMCO Mortgage QC Trends Report, showing critical defect rates improved from the fourth quarter to the first and in 2019 overall.

ARMCO: Critical Defect Rate Drops 9%

ACES Risk Management, Denver, said the overall critical defect rate reached 1.56% in the third quarter, to the lowest defect rate since 2016.

ARMCO: Critical Defect Rate Improves; FHA Loan Quality Decreases

ACES Risk Management, Denver, released its quarterly Mortgage QC Trends Report, showing a continued drop in overall critical defects but an uptick in FHA loan performance.