With regulators also tightening their expectations and requirements around compliance, there is no time better than the present for lenders to get ahead and shore up their quality control and quality assurance efforts to ensure a successful 2022.

Tag: ACES Quality Management

Sharon Reichhardt of ACES Quality Management: For a Successful 2022, The Season of Giving Must Include an Enhanced QC/QA Process

With regulators also tightening their expectations and requirements around compliance, there is no time better than the present for lenders to get ahead and shore up their quality control and quality assurance efforts to ensure a successful 2022.

Sharon Reichhardt of ACES Quality Management: For a Successful 2022, The Season of Giving Must Include an Enhanced QC/QA Process

With regulators also tightening their expectations and requirements around compliance, there is no time better than the present for lenders to get ahead and shore up their quality control and quality assurance efforts to ensure a successful 2022.

Industry Briefs Dec. 10, 2021: Beeline Completes Series A Funding

Beeline, Providence, R.I., a digital start-up mortgage lender, completed a Series A round of financing for an undisclosed amount. The capital will be invested in automation and artificial intelligence to improve the user experience for borrowers.

Sharon Reichhardt of ACES Quality Management: For a Successful 2022, The Season of Giving Must Include an Enhanced QC/QA Process

With regulators also tightening their expectations and requirements around compliance, there is no time better than the present for lenders to get ahead and shore up their quality control and quality assurance efforts to ensure a successful 2022.

Industry Briefs Dec. 8, 2021: Agencies Announce Dollar Thresholds for Exempt Consumer Credit/Lease Transactions

The Federal Reserve Board and the Consumer Financial Protection Bureau announced the dollar thresholds used to determine whether certain consumer credit and lease transactions in 2022 are exempt from Regulation Z (Truth in Lending) and Regulation M (Consumer Leasing).

Industry Briefs Nov. 5, 2021: Pretium Acquires Anchor Loans

Pretium, New York, a specialized investment management firm with $30 billion in assets, acquired Anchor Loans LP, a provider of financing to residential real estate investors and entrepreneurs

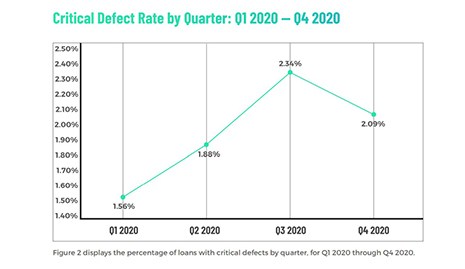

ACES: Q4 Critical Defect Rate Moderates, But Remains High

ACES Quality Management, Denver, said overall critical defect rates improved in the fourth quarter but remained high for calendar year 2020.

Industry Briefs May 27, 2021

Enact Holdings Inc., Raleigh, N.C., a provider of private mortgage insurance through its insurance subsidiaries, introduced its new brand and visual identity. Formerly known as Genworth Mortgage Holdings Inc., Enact is a wholly owned operating subsidiary of Genworth Financial Inc.

Nick Volpe: A Brief History of Defects; Q3 2020’s Loan Quality Performance Sets Stage for Areas of Concern in 2021

Given the necessary delay that must precede the analysis of post-closing data, it is easy to forget the significance of these findings. However, mistakes made in the past often do not remain so, especially when those mistakes go unaddressed. Thus, lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.