Advocacy Update: MBA Shares Housing Affordability Recommendations to Trump Administration Ahead of Upcoming Announcement

MBA Shares Housing Affordability Recommendations to Trump Administration Ahead of Upcoming Announcement

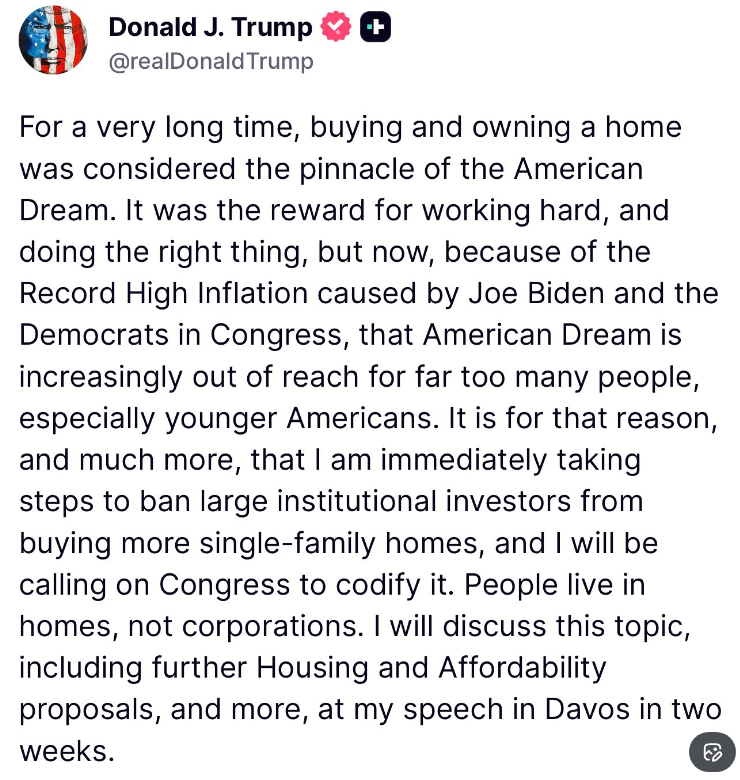

Ahead of an expected announcement in the coming weeks on “housing affordability policy actions,” President Donald Trump on Wednesday in a social media post (see image above) said that he is “immediately taking steps to ban large institutional investors from buying more single-family homes,” and that he will be “calling on Congress to codify it.” He also said that he will discuss this topic and more in his upcoming speech at the World Economic Forum’s (WEF) Annual Meeting on Jan. 19-23 in Davos-Klosters, Switzerland.

• Additional reporting, including from Politico, said that the White House is drafting an executive order on affordability, “including a push to allow people to dip into their retirement and college savings accounts to afford down payments on homes.”

• Late Thursday, President Trump in a separate social media post said that he was instructing his “representatives” (i.e. the GSEs) to buy $200 billion in mortgage bonds in an effort to bring down mortgage rates.

• It is likely that some of the forthcoming announced proposals, including a “ban on institutional investors purchasing single-family homes,” would require Congressional approval.

What they’re saying: In a statement shared with various media outlets, MBA President and CEO Bob Broeksmit, CMB, said, “MBA welcomes the Trump administration’s focus on making homeownership and rental housing more affordable and attainable for more Americans. We look forward to learning more about the Administration’s forthcoming proposals and have offered targeted recommendations to reduce housing costs. These include a potential reduction to FHA mortgage insurance premiums, reducing GSE loan-level price adjustments for middle-income buyers and for those seeking rate-and-term refinances, ending the tri-merge credit report mandate for lower-risk GSE-backed loans, reforming the mortgage loan originator compensation rule, improving construction loan options, seeking focused capital gains tax relief on the sale of a principal residence, and expanding condominium and multifamily lending through improved GSE and FHA policies.”

• Regarding the GSEs adding MBS to their portfolios, MBA has previously cautioned against such a move, recognizing that the potential gains of a modest temporary tightening of mortgage-to-Treasury spreads might not be worth the costs of increased volatility and unnecessary risks at the expense of the GSEs and taxpayers.

Why it matters: Last month, in response to requests from Treasury, the Department of Housing and Urban Development (HUD), Federal Housing Finance Agency (FHFA), and Fannie Mae and Freddie Mac (the GSEs), MBA shared its recommendations for policy actions that could be taken administratively that would directly reduce borrower costs. Among the ideas MBA recommended are the following:

• Reduce/restructure the FHA mortgage insurance premiums

• Reform the Loan Officer Compensation Rule to enhance lenders’ ability to compete on pricing (CFPB)

• End the tri-merge mandate and move toward single-file credit reports (FHFA/GSEs first)

• Reduce LLPAs, with a focus on the Purchase and Rate/Term Refi grids (FHFA/GSEs)

• Facilitate GSEs’ ability to do streamline rate/term refis (CFPB)

• Address supply by improving construction and condo lending offerings from the GSEs, FHA

• Revise insurance requirements on condos to expand eligibility for GSE financing (FHFA/GSEs)

What’s next: MBA remains actively engaged with the Administration and will continue working with the federal housing agencies and Congress to implement common sense policies and pass legislation – including a reconciled version of the House and Senate legislative housing packages (ROAD to Housing Act/Housing for the 21st Century Act) – that seeks to improve affordability for homebuyers and renters.

For more information, please contact Pete Mills at (202) 557-2878 and Bill Killmer at (202) 557-2736.

MBA, Trades Submit Coalition Letter to FCC on TCPA Proposed Rule

On Monday, MBA and several trade associations sent a joint letter to the Federal Communications Commission (FCC) praising the agency for issuing a Ninth Further Notice of Proposed Rulemaking.

• MBA and the signed groups have long urged the FCC to update its Telephone Consumer Protection Act (TCPA) rules to allow members to send time-sensitive, non-telemarketing messages to customers without delay. MBA applauds the Commission for proposing landmark, commonsense reforms to the outdated TCPA rules while also advancing measures to protect consumers from fraudulent calls.

Go deeper: In particular, the letter supports the reversal or modification of the Commission’s revoke-all rule and requests that the Commission also adopt an order extending the current April 11, 2026, deadline for implementing the revoke-all rule to 2027. The trade groups applauded the Commission’s proposal to permit callers to designate the exclusive means by which consumers may revoke consent to receive autodialed or prerecorded or artificial voice calls.

• This move will benefit consumers and businesses alike by discouraging consumers from sending messages with non-standard text and by better ensuring businesses can process revocations quickly and efficiently. Additionally, the group also commended the Commission for proposing enhancements to the STIR/SHAKEN call authentication framework, which will promote consumers’ confidence that the calls they receive are legitimate. Fraudulent calls that impersonate businesses pose a serious risk to consumers and erode trust in communications from the business.

Why it matters: Certain Commission rules implementing the TCPA impair businesses’ ability to place consumer-beneficial calls and messages, such as fraud alerts, fee avoidance alerts, data security breach notifications, and communications to service the customer’s account. The FCC initiating this rulemaking marks significant progress for MBA members on these issues. Efficient, effective communications are essential if banks, credit unions, other financial services providers, and other businesses are to serve their customers and comply with their regulatory obligations.

What’s next: MBA will update members with any new developments regarding this rulemaking.

For more information, please contact Alisha Sears at (202) 557-2930.

OCC Publishes Two Notices of Proposed Rulemakings on Escrow Accounts

On Dec. 23, the Office of the Comptroller of the Currency (OCC) published two Notices of Proposed Rulemaking (NPRs) protecting banks’ rights to manage escrow accounts.

• The first NPR, Real Estate Lending Escrow Accounts, proposes codifying the longstanding authority of national banks and federal savings associations to establish and manage real estate lending escrow accounts, including the discretion to set the accounts’ terms – such as whether to pay interest or charge fees – based on their business judgment.

• The second NPR, Preemption Determination on State Interest-on-Escrow Laws, proposes that the National Bank Act preempts New York General Obligations Law § 5-601, the state’s interest-on-escrow requirement, and that other states have substantively similar laws.

Why it matters: MBA has previously filed Amicus Briefs making similar arguments that the National Bank Act preempts state laws that restrict banks’ authority to set escrow account terms. Most recently, in the Kivett case, MBA filed an Amicus Brief asserting that state interest on escrow laws are preempted under the Dodd-Frank Act preemption framework. These efforts demonstrate MBA’s commitment to supporting consistent legal frameworks governing lending where possible.

What’s next: MBA plans to work with other trade associations to develop a response to the NPRs. Comments are due January 29, 2026.

For more information, please contact Justin Wiseman at (202) 557-2854, Alisha Sears at (202) 557-2930, or Kait Hildner at (202) 557-2933.

New York Finalizes CRA Regulation for IMBs

On Wednesday, the New York State Register (see page 15) included the announcement that the New York Department of Financial Services (NYDFS) has adopted regulations to implement New York’s 2021 law to impose Community Reinvestment Act (CRA) mandates on independent mortgage banks (IMBs).

MBA has led a coalition of allied trade groups, including the New York MBA, in commenting three separate times on this draft rule at different stages of consideration (December 2024, April 2025, and again in last October’s re-proposal), objecting to multiple provisions at each opportunity. IMBs are expected to be in compliance with these final regulations by July of this year, six months after the January 7, 2025, publication of the final rule.

Go deeper: The final rules retained the elimination of a statewide assessment area and instead relies on the licensee to designate one or more areas that meet specific criteria, including whether the IMB has branch locations in this state. Additionally, the final regulations do not include a set frequency of examinations. NYDFS may “from time to time” examine the IMB, but also may, in part, rely on another state’s examination.

Why it matters: New York originally enacted a state CRA for state-chartered banks and credit unions in 1978, but it is only the third state to implement a state CRA on IMBs. MBA and its state partners continue to fight against state community reinvestment laws, emphasizing that the concept of CRA does not fit the IMB business model, as IMBs do not extract deposits from local communities; rather, their core business model imports capital from global capital markets into local communities.

• Instead of expanding CRA, MBA has urged states to focus on programs and reforms that will expand access to credit and lower the cost of lending.

What’s next: MBA continues to partner with the coalition in addressing remaining uncertainty, like the frequency of examinations. Additionally, MBA and NYMBA will continue the push for NYDFS to eliminate the commutable distance requirements and adopt remote work policies which would expand the reach of IMBs into many communities in need.

For more information, please visit MBA’s State CRA resource center or contact William Kooper at (202) 557-2737 or Liz Facemire at (202) 557-2870.

MAA’s Next Quarterly Webinar: Jan. 29

With MBA’s National Advocacy Conference just a few months away, the Mortgage Action Alliance’s (MAA) upcoming webinar will spotlight this premier advocacy event, scheduled for April 14–15.

• Join MBA’s Legislative and Political Affairs Team to explore how national-level engagement strengthens state advocacy efforts and amplifies the industry’s collective voice. This quarterly webinar will feature a timely briefing on the year-end congressional closeout, an overview of the Q1 legislative agenda, and a look at MBA’s key policy priorities in this pivotal mid-term election year.

Why it matters: As our nation marks its 250th birthday, there’s no better moment than now to join hundreds of industry advocates and claim your seat at the table where meaningful change takes shape!

What’s next: Register for Part II of MBA’s State and Federal Advocacy Webinar & Fly-In Series, hosted by the California Mortgage Bankers Association, on Wednesday, January 21, at noon PT/3:00 PM ET. Part II will highlight the West and Midwest regions—but the session is open to MAA and MBA members nationwide.

For more information, please contact maa@mba.org or Margie Ehrhardt at (202) 557-2708.

Upcoming MBA Education Webinars on Critical Industry Issues

MBA Education continues to deliver timely single-family programming that covers the spectrum of challenges, obstacles and solutions pertaining to our industry. Below, please see a list of upcoming and recent webinars – all complimentary to MBA members:

• The High-Performance Manager: Proven Systems to Lead, Recruit, & Coach Winning Sales Teams – Jan. 20

• Decoding Customer Satisfaction and Loyalty: Key Insights from J.D. Power’s Latest Mortgage Studies – Jan. 21

• 1099 vs. W-2: Avoiding Costly Compliance Mistakes – Jan. 22

• Marketing Mastery for Loan Originators: Building a Consistent, High-Quality Pipeline – Feb. 9

• Renovation Lending Today: Market Trends, Best Practices & 203(k) Insights – Feb. 12

MBA members can register for any of the above events and view recent webinar recordings by clicking here.

For more information, please contact David Upbin at (202) 557-2931.