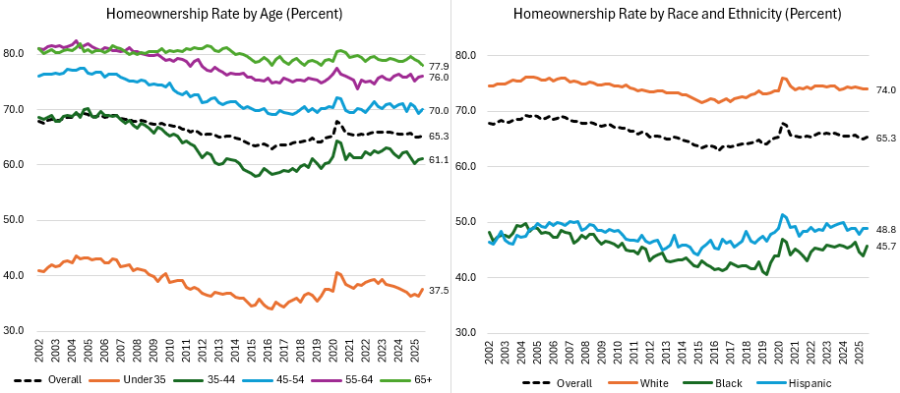

Chart of the Week: Homeownership Rates by Age, Race and Ethnicity

Source: U.S. Census Bureau, Current Population Survey/Housing Vacancy Survey

Recent housing policy proposals advanced by the Trump administration have focused primarily on improving home purchase affordability and expanding opportunities for households to gain a foothold on the “homeownership ladder.” Ensuring that young households—across all racial and ethnic groups—can achieve homeownership has long been a bipartisan priority, sustained across multiple administrations. Yet, although the barriers to progress are frequently identified, as highlighted in the 2024 Urban Institute event “Closing the Homeownership Gap: New Wealth-Building Tactics from Across the Country,” a fundamental question persists: How well are we actually doing?

In this week’s MBA Chart of the Week, we examine the homeownership rate by household age as well as by race and ethnicity. The overall homeownership rate of 65.3% in the third quarter of 2025 reflects a persistent level that has remained largely unchanged—indeed, effectively “stuck”—since the pandemic. Although this figure remains well below the peak of approximately 69% reached during the mid-2000s housing boom, it nonetheless represents an improvement from the lows of roughly 63% recorded a decade earlier. Given this context, an important question emerges: Are we making meaningful progress for younger and minority households?

To address this question, we first examine homeownership rates by the age of the household head. For the 35–44-year-old cohort, the homeownership rate fell by more than 12 percentage points from the housing boom to its trough a decade later. From a low of roughly 58% in 2015, the rate rose steadily, reaching approximately 63% by 2023. However, this progress has since reversed, with the rate declining to 61.1% in the third quarter of 2025. A similar pattern is evident among the youngest cohort, those headed by individuals under age 35, which has also experienced a negative trend over the past three years. Although the sizable 1.1‑percentage‑point increase to 37.5% in the third quarter of 2025 is encouraging, it remains uncertain whether this represents a meaningful shift or merely a temporary uptick.

The homeownership gap between white and Black households remains substantial at 28.3 percentage points. This level is broadly consistent with the average gap observed between 2002 and 2015. In 2019—the year immediately preceding the pandemic—the gap widened to 32.5%. Since then, however, the gap has narrowed, as Black homeownership rates have increased by as much as five percentage points while white homeownership rates have remained largely unchanged.

In economics, we distinguish between positive and normative analysis. The former concerns empirically verifiable statements about economic conditions, while the latter addresses questions of “what ought to be.” While the above commentary is largely positive in nature, I suspect that many readers are simultaneously considering the normative dimension—what the homeownership landscape should look like. It is in this vein that MBA continues its work, as exemplified by this week’s joint trades letter delivered to the White House National Economic Council.

– Eddie Seiler (eseiler@mba.org)