Millennials Say Financial Barriers Holding Them Back From Homeownership

(Illustration: Curtis Adams/pexels.com)

Three-quarters of Millennials believe homeownership is out of reach for the average person in their generation and 61% say buying a home makes them feel in over their heads financially, according to Clever Offers, St. Louis.

Although 40% of millennial home buyers say they’re “desperate” to buy a home in 2026, nearly all–97%– report facing at least one barrier to homeownership, according to a new report from Clever Offers, St. Louis.

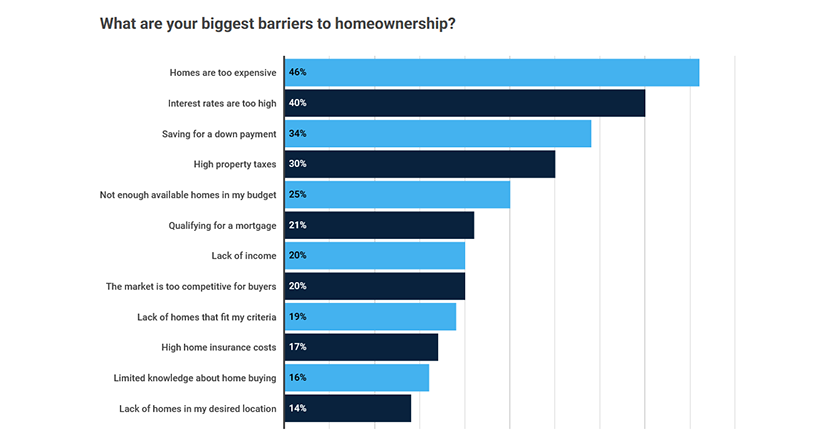

Financial hurdles top millennials’ home-buying challenges, with the most common barriers being expensive homes (46%), high interest rates (40%), difficulty saving for a down payment (34%) and high property taxes (30%).

Although the median U.S. home costs $410,800, 59% of millennials plan to spend less than $400,000 on their home purchase, including 67% of first-time buyers.

More than three-fourths of millennials (78%) say potential interest rate drops in 2026 would entice them to buy, but 51% would only consider purchasing if rates fall below the current level of about 6%.

Conversely, nearly half of millennials would consider accepting an interest rate above 6%, while 44% say they’d be willing to spend more than half of their monthly income on housing to afford a home.

Although more than one-third of millennials say homeownership would be more affordable with their own better spending habits, most note they aren’t willing to cut back on gym memberships (77%) or subscription services (71%).

Based on their current savings, just 28% of millennials could afford a 20% down payment on a median-priced home, and fewer than half (45%) have enough for a 10% down payment, Clever Offers reported.

Compounding those challenges, 1 in 4 millennials (24%) carry more debt than savings, the report said.