Investors Set to Deploy More Capital as CRE Market Stabilizes: CBRE

(Image courtesy of Constanze Marie/pexels.com)

Investors are preparing to deploy more capital into the commercial real estate market in 2026, supported by stabilizing pricing expectations, improved fundamentals and optimism about declining debt costs, according to CBRE, Dallas.

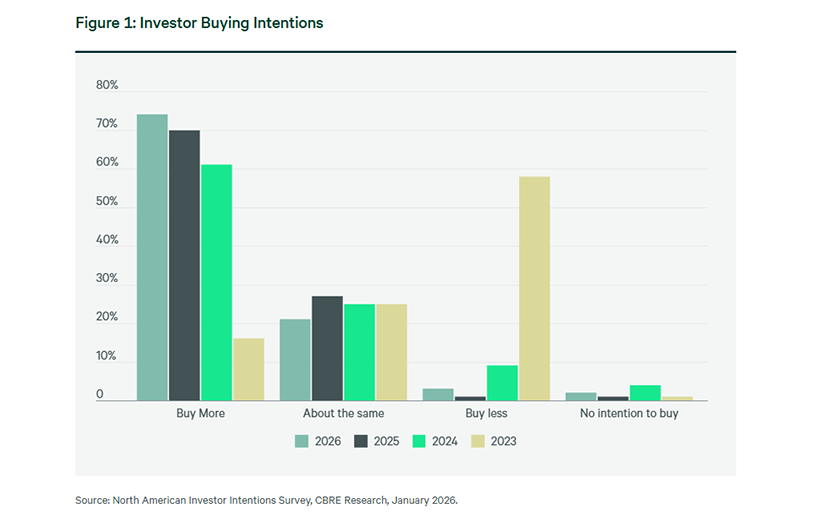

The firm’s 2026 North America Investor Intentions Survey found that 95% of investors plan to buy as much commercial real estate assets as they did last year and possibly more.

This investment growth will be fueled by additional capital. CBRE said 55% of investors plan to increase their capital allocation to real estate this year, up from 48% who said the same a year ago. “Together, these signal renewed investor conviction,” the report said.

“Investors are approaching 2026 with optimism about the continued recovery of commercial real estate, even as they navigate political uncertainties affecting the broader economy,” said Tommy Lee, CBRE President and Co-Head of Capital Markets for U.S. & Canada. “Despite these challenges, stabilizing debt costs and attractive entry points for pricing are driving investor confidence, as many see this as an opportunity to secure high-quality assets and position themselves for long-term growth.”

The top markets for investment, per CBRE:

• Dallas remains the most attractive market for U.S. investors for the fifth consecutive year, followed by Atlanta and San Francisco.

• New entrants to the top 10 most attractive markets include Charlotte, Nashville, Tampa and Seattle.

• Investors remain focused on high-growth Sun Belt markets, while simultaneously pursuing discounted opportunities in gateway cities.

Multifamily remains the most sought-after property type by a wide margin, with 74% of U.S. investors targeting this sector. Industrial & logistics is the second most-preferred sector, targeted by 37% of U.S. investors, followed by retail (27%) and office assets (16%).

“High-quality assets across all property types remain the top priority for investors, reflecting a discerning approach to market and asset selection,” the report said. “Among alternative assets, self-storage, land, industrial outdoor storage, cold storage, and healthcare were most favored. However, only 11% of investors indicated they are interested in alternative assets, preferring to focus on repriced opportunities in traditional sectors.”

Looking at investment strategies, CBRE said value-add and core-plus are preferred, chosen by two-thirds of investors, reflecting a preference for moderate-risk opportunities with higher returns. “Core strategies gained modest traction, while opportunistic, distressed and debt strategies declined. Investors are adapting their strategies as the market cycle evolves, favoring moderate-risk opportunities with higher returns.”

More than 70% of investors plan to maintain the same debt-to-equity ratios as last year, CBRE found. Nearly 50% of investors are willing to endure one year of negative leverage.

The report noted several challenges for investors, including uncertainty about the direction of interest rates and the reduced size of refinanced loans due to lower capital values.