Defined Contribution Capital in Private Real Estate Tops $45B

(Image of New Orleans courtesy of Scott Webb/pexels.com. Chart courtesy of Private Real Estate in Defined Contribution Survey)

Capital flows from defined contribution investors into private real estate strategies turned positive last year, with a net $418 million of DC capital moving into real estate, according to the new Private Real Estate in Defined Contribution Survey.

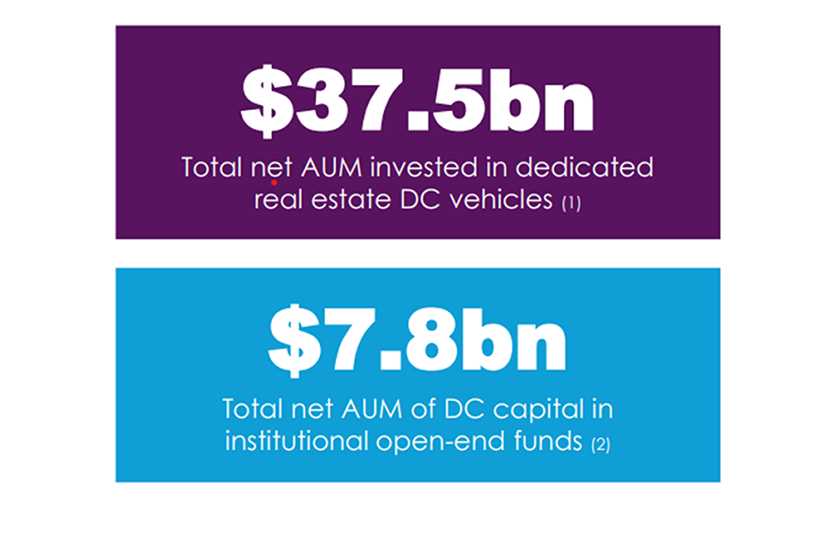

The survey, released by the DC Real Estate Council, NAREIM, NCREIF and PREA, found that more than $45 billion of defined contribution capital was invested in private real estate strategies as of year-end 2024. $37.5 billion of that total was held in dedicated DC vehicles; $7.8 billion was invested through institutional open-end funds.

“During 2024, DC investors contributed $1.8 billion in new inflows to private real estate, while outflows totaled $1.2 billion, resulting in net positive inflows of $418 million,” the report said.

The survey, conducted between May and July 2025, reflects responses from 21 firms representing more than $1.3 trillion of gross assets under management across the industry.

DC real estate allocations remain highly concentrated in dedicated DC structures, the survey noted.

Key highlights included:

• 88% of inflows were directed to dedicated DC vehicles, with only 12% to institutional vehicles.

• Outflows followed a similar pattern, with 53% of redemptions from dedicated DC vehicles and 47% from institutional strategies.

• Asset mix: The typical dedicated DC vehicle holds 87% of assets in private real estate, 11% in listed REITs and 2% in cash equivalents.

• FTEs: Most real estate firms have just one dedicated FTE focused on DC, with half having a real estate background and one third a DC background.