CBRE: Declining Single-Family Affordability Bolsters Multifamily Demand

(Photo credit: Mike Sorohan. Chart: CBRE)

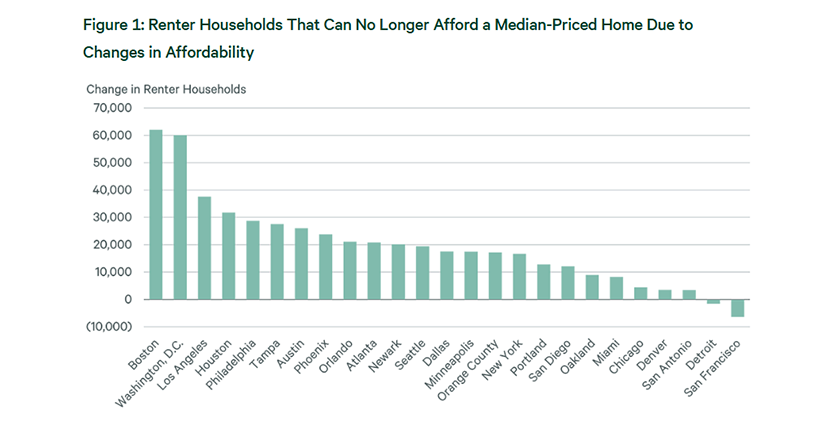

High mortgage rates and elevated home prices have pushed homeownership further out of reach for an additional 1.8 million U.S. renter households, according to a new analysis from CBRE, Dallas.

“A growing affordability gap means these households can no longer afford a median-priced home in their market, a trend that has accelerated over the past five and a half years,” CBRE said in Fewer Renter Households Can Afford Homeownership.

The report noted the growing financial gap between renting and owning is keeping more households in the rental market, which continues to drive strong demand for multifamily housing. CBRE forecasts that multifamily occupancy rates will remain above historical averages for years to come. “This ongoing supply-demand imbalance is expected to support near-term rent growth, underscoring the critical role the multifamily sector plays in addressing the nation’s housing needs,” the report said.

“For many Americans, renting is the most financially viable and flexible housing option,” said Matt Vance, Americas head of multifamily research for CBRE. “Closing the affordability gap between renting and homeownership will require a combination of declining home prices, lower interest rates, rising incomes and strong rent growth.”

Vance noted this scenario will take years to play out. “In the meantime, we expect elevated multifamily occupancy rates to persist as the rental market continues to meet the demand for housing,” he added.

While home prices have stabilized or declined slightly in some U.S. markets, they remain unaffordable for many households. The National Housing Conference recently found that middle-class Americans now face a housing affordability crisis once reserved for low-income families.

Nationally, the average cost of owning a home is now $4,643 per month—more than double the average monthly rent of $2,228, CBRE calculated. This equates to a 108% premium for owning versus renting. Although this is down from a peak of 128% in late 2023, it remains well above the pre-pandemic average of 68%.

CBRE said the share of renters who can afford a median-priced home has dropped sharply, falling to 12.7% from 17.0% in 2019. Upfront costs are a major barrier: a 20% down payment on a median-priced home now equals approximately four years of average apartment rent. “In high-cost markets like Orange County, Calif., that figure can rise to eight years or more,” the report said.