Fannie Mae HPSI Sees Slight Decrease in August

(Image courtesy of Luis Yanez/pexels.com)

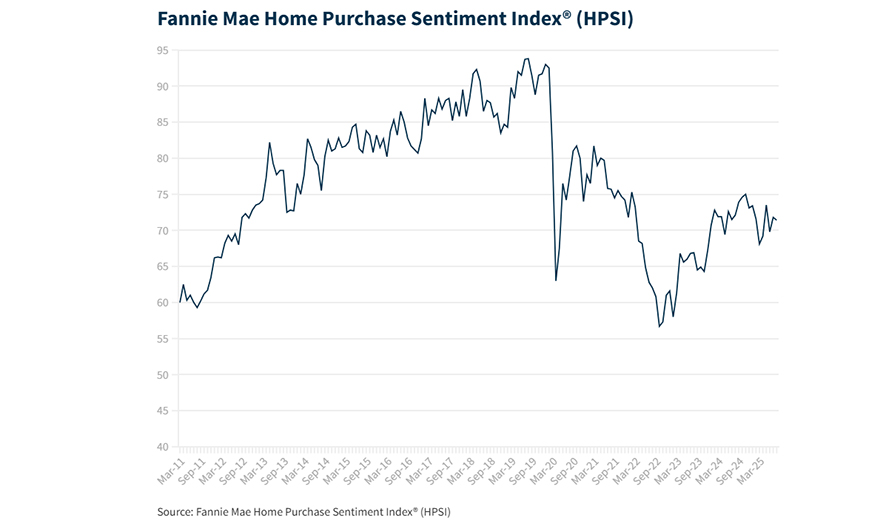

The Fannie Mae Home Purchase Sentiment Index fell 0.4 point to 71.4 in August.

The HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions.

Twenty-eight percent of respondents think it’s a good time to buy, compared with 72% who disagree. The positive metric is up slightly from July, when 23% thought it was a good time to buy.

On the other hand, 58% think it’s a good time to sell, and 41% think it’s a bad time. That’s near flat from July, when 60% thought it was a good time to sell.

Forty percent of respondents believe home prices will go up over the next year, while 22% think they’ll decrease.

On average, they believe home prices will increase 1.4% over the next year.

The share of respondents who think rental prices will go up was at 63%. On average, they expect rental prices to increase 4.9% over the next year.

And, 33% think mortgage rates will go down, compared with 26% who think they’ll go up.

The majority–72%–are not concerned about job loss over the next 12 months. Also, 17% report that their household income is significantly higher than it was a year ago. Twelve percent say their income is significantly lower.

The share of respondents who would purchase a house if they had to move was at 68% in August, and the share who said getting a mortgage would be difficult was at 55%.