Realtor.com: Down Payments Near Flat in Q3

(Image courtesy of Alex Romo/pexels.com)

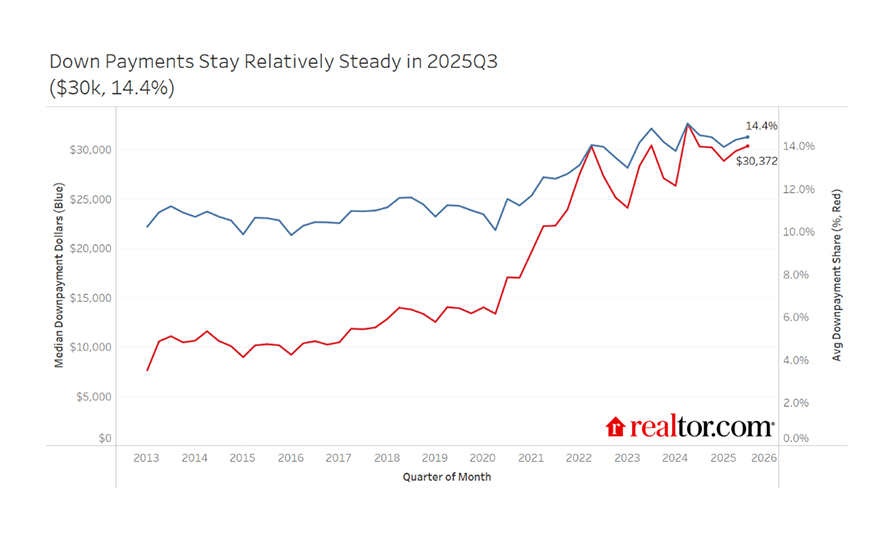

Realtor.com, Santa Clara, Calif., reported down payments in Q3 held at an average of 14.4%, with a median down payment of $30,400 in the third quarter.

That’s up 0.1 percentage point from Q2 and down 0.1 percentage point from a year earlier. Monetarily speaking, it’s an increase of about $500 from Q2 and flat year-over-year.

However, it’s an increase of 117.9% from the $13,900 average in Q3 2019.

Historically, down payments have risen sharply from spring through late summer before cooling. But, in 2025, that trajectory was more modest–pointing to a cooler, steadier housing market, Realtor.com described.

In general, economic and market conditions have pushed housing activity this year toward the upper end of the market–sales of homes priced above $750,000 rose 5.8% year-over-year in the first seven months of the year. In contrast, sales below $750,000 fell 3%.

Down payments for investment properties and second homes tracked significantly above primary-residence down payments in the quarter. For investment properties, they averaged 26.7% of the purchase price, or $84,200; for second homes they were 26.9%, or $110,100.

However, both of those metrics saw their lowest down payments shares in three years.

Regionally, down payments were highest in the Northeast, averaging 18.2%. They were 16.3% in the West, 14.5% in the Midwest and 12.5% in the South.

The median FICO score was 735 in Q3, near its highest level in more than a decade. That’s 20 points higher than the national average credit score, and consistent with the concept that more financially stable buyers are the ones currently taking the plunge.