CoStar: Commercial Asset Price Trends Vary by Value

(Cover illustration courtesy of Savanna Blanchette/pexels.com)

CoStar, Arlington, Va., said commercial asset price trends varied by property value in August.

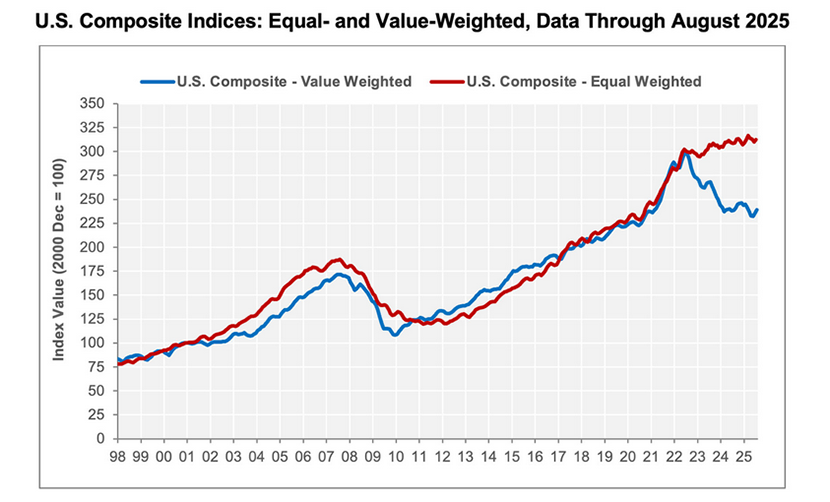

The research firm’s value-weighted price index, which is more heavily influenced by high-value trades common in core markets, increased for the second consecutive month to 239, a gain of 1.3% compared to the prior month. Measured against August 2024, the index was flat and was off by 20.1% from the July 2022 all-time high.

But CoStar’s equal-weighted price index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, declined 0.1% during the month to 312. The index increased 0.9% in the 12 months ending in August 2025 and was 1.5% below the March 2025 record high.

“After four consecutive months of year-over-year value-weighted price declines, August 2025 marked a pause in this downward trend,” the report said. “The value-weighted U.S. composite index was even with levels from August 2024 and on par with March 2021.”

On a year-over year basis, transaction volume moved higher in August, CoStar said. Transaction activity climbed to $10.7 billion in August 2025, a 3.6% increase from August 2024. Investment-grade transaction volume fell 0.2% in August 2025 to $6.2 billion, while the general commercial segment climbed 9.7% over the prior year to $4.4 billion.

CoStar reported distressed repeat-sale trades declined in August. Approximately 40 of the 1,479 repeat-sales trades in August, or 2.7%, were distressed sales. 23 general commercial distressed sales totaled 1.8% of all general commercial repeat sales in August 2025. There were also 17 distressed investment grade repeat sales recorded in the month, accounting for 8% of all investment-grade repeat sales.