FundingShield: Q3 Saw Record Wire, Title Fraud Risks Per Transaction

(Image courtesy of Josh Sorenson/pexels.com)

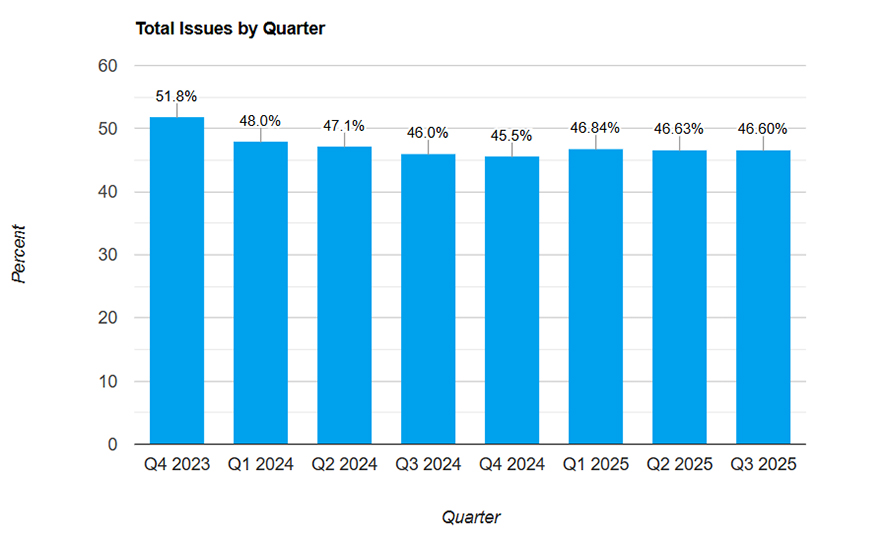

FundingShield, Newport Beach, Calif., released its Q3 Wire Fraud Analytics and Risk Report, finding that nearly 46.6% of transactions were flagged for issues posing significant wire and title fraud risks. Each of those loans had an average of 3.1 issues per transaction, a record high and an increase of 35% from Q2.

In terms of percentage of transactions, 46.6% is flat from the 46.63% recorded in Q2, but down substantially from the 51.8% logged in Q4 2023, a recent high.

The portfolio containing the loans totaled approximately $90 billion, spanning residential, commercial, non-QM and business-purpose loans.

Q3 2025 specifically saw record-high CPL validation errors, at 10.52% of transactions. Some pain points included borrower information, vesting parties, non-borrowing title holders and property addresses.

CPL issues in general were present in 50.07% of transactions, up from 44.43% in the previous quarter.

Wire-related errors were present in 9.14% of transactions. That’s the eighth consecutive quarter above 8%, FundingShield noted.

License issues were at 2.19%, driven by entities with lapsed, terminated or suspended licenses and inconsistent data across registrars, insurance regulators and licensing bodies. There was a 23.11% quarter-over-quarter increase in license-related issues.

Wire-related issues were at 9.14%, up from 8.57% in the previous quarter, and insurance issues were at 1.55%, up from 1.33% in Q2.