Delayed September Jobs Report Shows 119,000 Gained; Industry Economists Weigh In

(Image courtesy of Following NYC/pexels.com)

The Bureau of Labor Statistics Nov. 20 released jobs data for September, delayed because of a lapse in federal appropriations during the government shutdown. The report found total nonfarm payroll employment grew by 119,000 in the month.

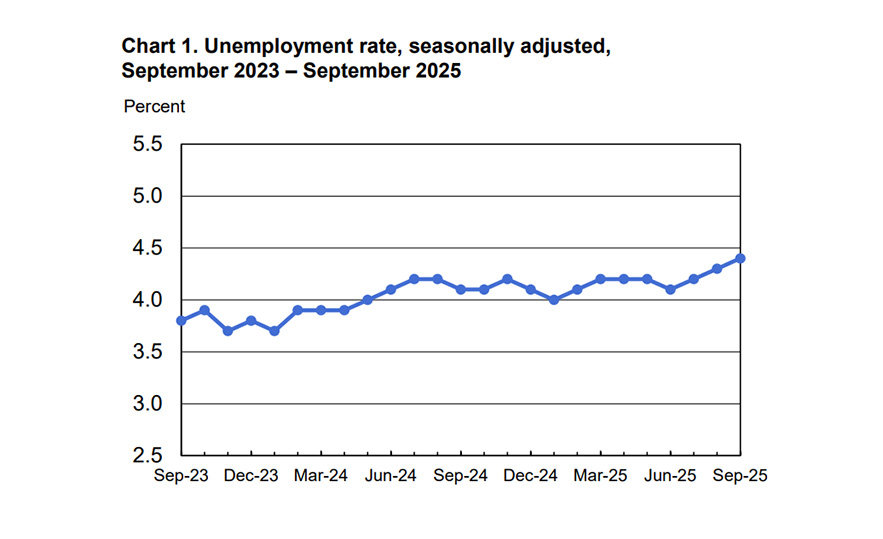

The unemployment rate, at 4.4%, rose slightly in September.

Employment trended up in health care, food and drink services and social assistance. Job losses occurred in transportation and warehousing, and from the federal government.

The change in total nonfarm payroll for July was revised down by 7,000, from 79,000 to 72,000. The change for August was revised down by 26,000, from 22,000 to negative 4,000.

“Wage growth was at 3.8% over the last year and 0.2% in September, which was a decrease compared to the prior month,” noted MBA SVP and Chief Economist Mike Fratantoni. “The unemployment rate increased to 4.4% in September. Individuals who lose a job continue to have more challenges finding a new one, with the average duration of unemployment at 24.1 weeks.”

“Despite the larger-than-expected increase in payroll employment in September, on net, this report aligns with other data showing a somewhat softer labor market, but not one that is rapidly declining in strength. Although these data are not as timely as usual, they should still help inform the FOMC’s December decision regarding a potential cut. We expect another 25-basis-point cut in December, but also expect a number of dissenting views from FOMC members who will vote to hold rates,” Fratantoni said.

“As the last jobs report released before the Federal Reserve’s December meeting, September’s jobs data delivers a mixed message: stronger-than-expected job growth points to resilient labor demand, while rising unemployment–the Fed’s preferred gauge of labor-market slack–will certainly grab policymakers’ attention. Hawks will argue inflation remains too high for more cuts, while doves see rising unemployment as justification for additional support,” observed First American Senior Economist Sam Williamson.

“With a December rate cut still far from certain, mortgage rates are likely to stay close to current levels for now. Even so, they’re now sitting near one-year lows and have pulled back from about 7% in January, giving buyers a bit more breathing room. While there may be some short-term volatility, the current range offers a fairly dependable floor–enough to encourage more buyers off the sidelines,” Williamson continued.

BLS will not publish an October 2025 jobs release, but establishment survey data will be published with the November 2025 data. Household survey data was not collected for the October 2025 reference period due to the shutdown.

The employment situation news release for November is scheduled to be published on Dec. 16 due to an extension.