RealPage Reports Strong Retention Offsets Cooling Apartment Demand

(Cover/thumbnail photo credit Mike Sorohan. Chart below courtesy of RealPage)

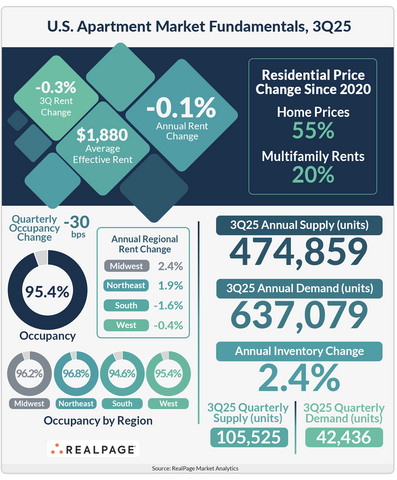

The average advertised apartment rent decreased during the third quarter–for only the second time since 2009–according to RealPage, Richardson, Texas.

But RealPage noted that home values have risen at twice the pace of market-rate rental units since 2020, pushing the typical mortgage payment well above the nation’s average rent and keeping many households in the rental market longer.

“Resident retention has increased and is approaching an all-time high as the current cost of renting is significantly less expensive than homeownership,” RealPage Chief Economist Carl Whitaker said.

Nationwide, supply growth is starting to cool, with 105,000 units delivered in the third quarter, which is the fewest since second-quarter 2023 and a 35% decline from a year ago. The 324,000 units scheduled to be completed in the next 12 months would be the fewest in a given 12-month window since the second quarter of 2020.

“Construction activity shows supply will remain below normal for some time once this current wave of deliveries subsides,” RealPage said. Currently, just 519,000 market-rate apartment units are under construction nationally; the fewest in more than 10 years.

“The outlook for the U.S. apartment market in the next 12 months is that supply will cool considerably from its current level,” Whitaker added.