MBA: Mortgage Delinquencies Increase in Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.99% of all loans outstanding at the end of the third quarter of 2025, according to the Mortgage Bankers Association’s National Delinquency Survey.

The delinquency rate was up 6 basis points from the second quarter of 2025 and up 7 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the third quarter rose by 3 basis points to 0.20%.

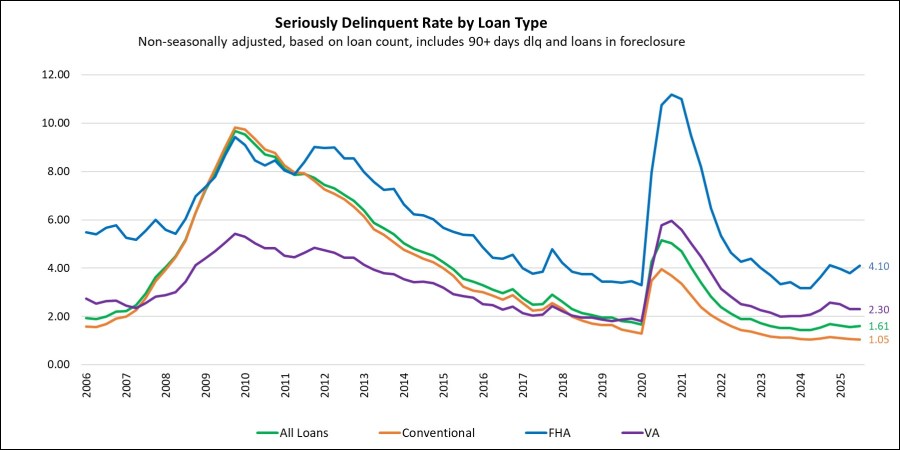

“Mortgage delinquencies increased in third quarter of 2025, led by worsening FHA loan performance,” said Marina Walsh, CMB, MBA’s vice president of industry analysis. “Since this time last year, the FHA seriously delinquent rate – which includes 90+ day delinquencies and loans in foreclosure – increased by almost 50 basis points. In contrast, the conventional and VA seriously delinquent rates remained relatively flat.”

Added Walsh, “The stressors on FHA homeowners include a softer labor market, other personal debt obligations, and increases in taxes, homeowners’ insurance and other fees that exacerbate already stretched affordability. Additionally, home price declines in some parts of the country may lessen the ability to sell or refinance.”

Walsh also noted that while the third quarter results were not impacted by the ending of COVID-era FHA loss mitigation options and the recent government shutdown, those events may affect future quarters.

Key findings of MBA’s Third Quarter 2025 National Delinquency Survey:

• Compared to last quarter, the seasonally adjusted mortgage delinquency rate increased for all loans outstanding. By stage, the 30-day delinquency rate increased 2 basis points to 2.12%, the 60-day delinquency rate increased 4 basis points to 0.76%, and the 90-day delinquency bucket remained unchanged at 1.11%.

• By loan type, the total seasonally adjusted delinquency rate for conventional loans increased 2 basis points to 2.62% over the previous quarter. The total FHA seasonally adjusted delinquency rate increased 21 basis points to 10.78 percent, and the total VA seasonally adjusted delinquency rate increased 18 basis points to 4.50%.

• On a year-over-year basis, total mortgage delinquencies increased for all loans outstanding. The delinquency rate decreased 1 basis point for conventional loans, increased 32 basis points for FHA loans and decreased 8 basis points for VA loans from the previous year.

• The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 0.50%, up 2 basis points from the second quarter of 2025 and 5 basis points higher than one year ago.

• The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.61%. It increased 4 basis points from last quarter and increased 6 basis points from last year. The seriously delinquent rate decreased 2 basis points for conventional loans, increased 30 basis points for FHA loans, and decreased 1 basis point for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased 4 basis points for conventional loans, increased 47 basis points for FHA loans and increased 4 basis points for VA loans.

• The five states with the largest quarterly increases in their overall delinquency rate were: Arizona (29 basis points), Louisiana (28 basis points), Indiana (28 basis points), Iowa (26 basis points), and Texas (24 basis points).

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

NOTE: For non-seasonally-adjusted supplemental information on the performance of servicing portfolios by investor type, loans in forbearance by investor type, and the status of post-forbearance workouts, as well as servicer call volume metrics, please refer to MBA’s Monthly Loan Monitoring Survey at www.mba.org/lms.