Surviving a “Stage of If’s”— Using Data

The Backdrop: The mortgage industry flourishes during times of low interest rates, economic certainty, and consumer optimism. In late 2024, after two back-to-back years of tracing three-decade lows, projections for origination volumes and new home building rose as estimates for 2025 approach $2.4 trillion (> 30% increase from the prior years).

Alas, those hopes and expectations were short lived. Now in May 2025, numerous economists are now calling for a recession (JPMorgan, likelihood >=60%). To holistically illustrate the cascading risks and impacts underway let’s review a few indicators:

Q1 economic activity contracted into negative territory (0.3% contraction—compared to original consensus estimates of 2.4% growth),

Global tariff induced trade war in underway perhaps shrinking U.S. GDP >3% by end of 2025,

Consumer sentiment is now at its second lowest dating back to 1952,

Housing supply now varies between 8 to 10 months (Federal Reserve)

Layoffs are mounting within industries across public and private entities,

Home buyers walking away from their purchase contracts have spiked,

Stock markets have significantly declined and continue to whipsaw, and

The Federal Reserve is again concerned about inflation thereby freezing any interest rate actions until at least the second half of 2025.

Taken holistically, the result is that mortgage origination dollar volume is now projected to be around $2 trillion with lower revisions anticipated—even as loans interest rates have stabilized. In addition, as we know from generations of homeowners, their mindsets and risk certainty need to align with their housing demands or volumes decline and negative impacts escalate.

Setting the Stage, Putting it All Together: Today, the industry is participating in a fictional, Broadway show playing out with IMBs, credit unions, and retail banks as unwilling actors—a production titled as a “Stage of If’s.” If trade wars persist, if supply chains impact consumer buying, if job opportunities impact demand and credit scores, and if sentiment transfers into consumer buying changes, as the list of “ifs” expands weekly.

The uncertainty continues—and the “unintended consequences” are yet to be revealed. The impacts are just now emerging against the rationale presented in the evolving bulleted list above.

So, what are strategic and tactical paths to survive an uncertain 2025? What will these interconnected, cascading backdrop trends mean for real estate, lending, servicing, and securitization? And, when it comes to innovations like AI, what are the recommendations against changing macro and micro economics all impacting business models and solutions deployed?

Why it Matters: To survive 2025 after the two previously low watermark years, organizational leadership even in an Age of AI efficiencies will need to:

Design smaller, compartmentalized capabilities using a common blueprint,

Identify and prioritize risks (and their solutions),

Delay “shiny” technology in favor of robust ROI’s (e.g., MoSCoW user stories),

Consolidate disparate legacy technologies (i.e., technical debt),

Conduct tactical innovation acquisitions driving cost reductions or containment,

Execute with precision using shorter timeframes leveraging experienced personnel, and

Assess and iterate—that is “rinse and repeat” across 90-day intervals.

While the seven steps process appears straightforward, it is its granular application especially around four core innovation pillars where success can be achieved—a) people, b) process, c) technology, and d) data. These independently viewed classifications add layers of risks and complexity, demands for interoperability, and conflicting success criteria when viewed through the lens of traditional software, legacy technical debt, and varied cloud implementations.

Bringing it All into Focus: The strategy of data was once considered part of the IT Ivory Tower approach to managing cloud and on-premise software solutions—nice idea but completely impractical. Now with ubiquitous cloud offerings and exploding multimodal AI capabilities, we take a deep dive into the 2025 backdrop with the seven-step process and apply it to only one of the innovational four pillars—data and its implications.

Whereas data is typically framed in the context of applications, the rise of advanced, compartmentalized data management solutions are being defined and incorporated into sophisticated, federated AI solutions (i.e., no longer a single LLM or SLM). These advancements represent quantum shifts across data management, lineage, and auditing capabilities that have been decades in the making, yet previously huge expenses with little bottom line returns against ROI demands.

However, with the capabilities now matching enterprise data visions and requirements (e.g., data as a product—DaaP, data as a service—DaaS, data meshes, fabrics, and weaves) the natural instinct of strategists and architects are to BUILD BIG! Analogous to building Notre Dame Cathedral from the foundations up after its fire, the complexity and layers of modern data across technology and applications integrating structured, unstructured and semi-structured data enveloped within generative AI, RAG, and Agentic AI is a valid approach, but a practical impossibility.

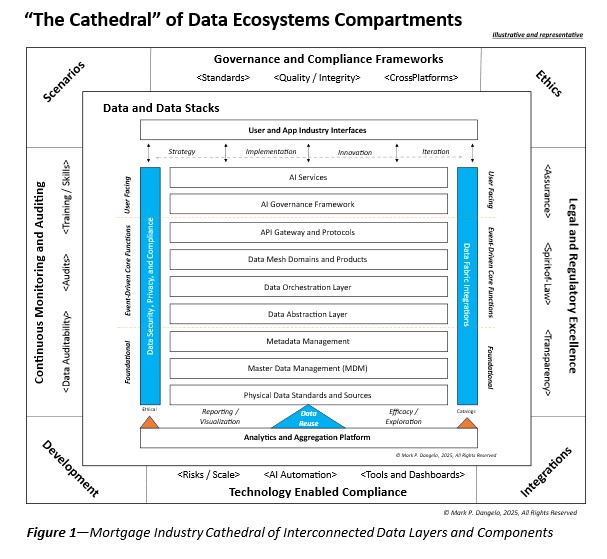

To illustrate a comprehensive data blueprint, Figure 1 represents a robust “data cathedral” architecture that while valid, cannot be implemented as a single program. And when it comes to the backdrop of 2025 market actions above, mortgage industry data solutions must be discrete and concentrated on a limited set of criteria, use cases, and epic stories all foundationally built on standards such as MISMO.

The business drivers behind the development of a large, comprehensive data architecture in an Age of AI are powerful: data de-duplication, auditability, governance, quality, reusability, efficiency, lineage, compliance, and ROI. For crosslinked mortgage systems within origination, into servicing, and into securitization, the data demands continue to grow beyond the traditional with AI systems now becoming independent, federated, and privacy preserving data architectures needed continuous adaptation and retraining.

Reality Smacks Data Theory: However, to achieve these goals, leaders must deliver the cathedral-lite design using short-burst data-driven methods such as orchestration, reusable agents (e.g., DIMs), multimodal clouds, registries, interconnected messaging and security (e.g., MCP), and most importantly, componentization. And none of this is trivial and most is unfamiliar given traditional cloud and system designs driven by discrete process improvement FinTech and RegTech capabilities.

Consequently, to secure practical, implementable solutions for data within another year of market uncertainty, business scrutiny over data cathedral designs will not resonate with organizations struggling to survive. Practical adjustments must be made on the delivery of MVP’s (minimal viable products), use of open-source tools, cross-training of personnel, and prioritization of data pipelines and ingestion designs (e.g., data weaves and meshes).

The “why it matters” is clear—deliver expandable, next-gen data domains rather than replicate siloed process encased data. Vast data designs, conversions, and even EDM’s are likely out-of-reach for many mortgage and BFSI operations today. The strategy defined data architectures still are excellent roadmaps, but they represent the foundation for the use cases that are actionable within the structures of data architectures.

These user stories and their epics are the means to identify and deliver MVPs as part of the architecture, while also identifying what success criteria will be used within timeboxes or Agile sprints to book results and alter subsequent expansions.

Solutions for Success—Run Hard, Fast, and Lean: Against the backdrop of markets, consumers, and technology, 2025 success means thinking BIG—but starting small.

Cost is a feature: Every design choice must prioritize building block design, adoption within legacy, and adaptability for new requirements.

Simplicity wins: While the cathedral design represents data engineering excellence, over-engineering with a demand for perfection will build out more than is needed to meet the success criteria and cost features.

Risk First: Always prioritize the “next thing” for customers, regulators, and organizational transformation—not just SOA (state-of-art) technology or applications. Data is the largest risk for the future, so we start there.

Success Defined Before Starting: Success criteria need to deliver the prior three elements above, but recognize that there is no prescription—just best practices. Criteria will change due to booked results, failures, and evolving market conditions.

Let’s explore this last item, defining success with the demands of delivery, for the rest of this article. While data discussions often focus on ingestion, accuracy, conversion, recovery, and technology, today’s mortgage markets are built on robust standards. When applied to an uncertain 2025, data architectural consistency underpinning AI advancements in clouds, servers, and application linkages represent the urgency needed for data carve out sprints against tightly-coupled business functionality.

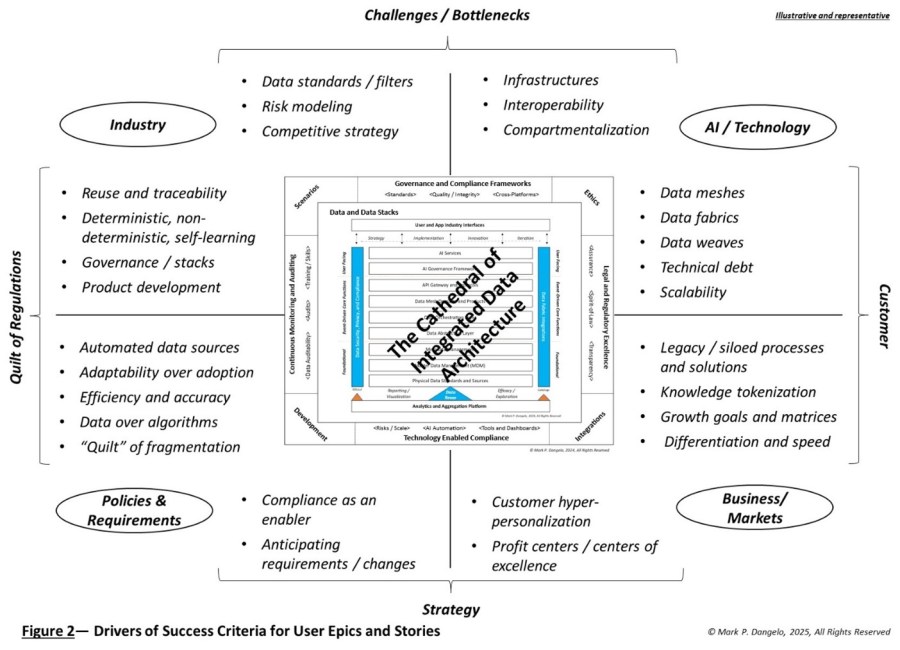

Using the large cathedral framework but adapting it to today’s pressures—consumers, mergers and acquisitions (M&A), competitive demands, oversight, and legacy debt—it will be the success measurements that will guide the burst of delivery actions when it comes to achieving segments of a comprehensive data ecosystem. Figure 2 below represents the domains of interest (from the outside in) using sprints and stories that will have to be undertaken to navigate the economic uncertainty facing enterprises for the remainder of 2025.

The illustration demonstrates that while large, complex data architectures should not be a one-and-done implementation, it is the varied criteria unique to each organization based on applying experienced personnel that makes the framework real, actionable, and iterative.

In the End: Data architectures are no longer application defined or constrained. They are the enablers for all ML / AI advancements and require a common, purpose-built design. From an engineering mindset, this article practically outlines forth the “crawl-walk-run” context that consistently delivers innovation results even across vast uncertainty.

The “Stage of If’s” is now playing out, but it brings into focus the growing reality that data is the consistent and possesses the greatest ROI for emerging technologies such as ROI. It also highlights the current poor quality of data housed within and across mortgage and financial institutions.

It puts the stage spotlights on the lack of standards for conversions from prior systems, previous M&A efforts that failed to address data, labor arbitrage in favor over experience, and how all of these siloed data sources remain auditable across structured, unstructured, and now growing synthetic data.

Emerging technologies like AI are putting the limelight on data—and this will likely be a permanent transformation. The market hardships will focus a reassessment of processes and budgets. The “stage set” will be changing with more “ifs” including consumer behaviors, supply chains (impacting remodels and construction), and risk profiles. AI long hyped will be entering its expansive stage meaning more options, more precision, greater independence, and most importantly lower entry.

Bottom line is data is the foundation and there needs to be architects, strategists, and product design personnel who will lead from the front using proven data integration experience—not just a vendor with a point-based offering.

Real estate markets are about location, location, location. IT markets have been about SOA, innovation, and product design. Business leaders demand efficiencies, competitiveness, and voice of the customer. Mortgage lenders address origination, servicing, and securitization. Data leaders must bring all of these together under a common umbrella.

Will 2025 represent a short-lived aberration or longer-term opportunity? For our Stage of If’s, we are still awaiting the final act of the data script. Who will be on stage for the final curtain call?

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)