ACES: Critical Defect Rate for Q4 2024 Drops

(Image courtesy of ACES; Breakout image courtesy of Curtis Adams/pexels.com)

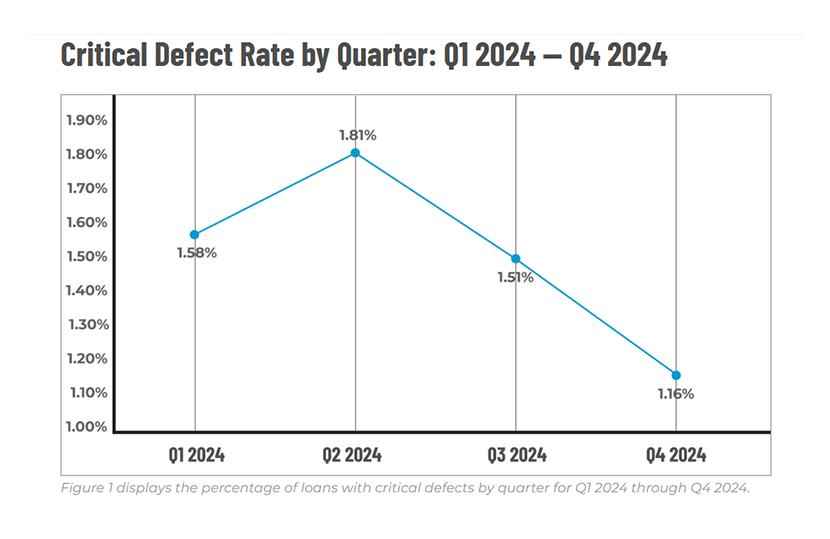

ACES Quality Management, Denver, saw the overall critical defect rate for Q4 2024 drop to 1.16%, the second lowest level since ACES began compiling the report.

That’s also a 23.18% improvement from Q3.

In Q4, Assets, Income/Employment and Credit improved, and Legal/Regulatory/Compliance–up by more than 200%–and Product Eligibility saw increases.

And, Legal/Regulatory/Compliance emerged as the leading defect category, the first time in more than three years that Income/Employment didn’t hold the top spot. However, the category tends to be volatile, and due to no evidence of a major trend shift or policy change, ACES anticipates this status will be temporary.

“Lenders made meaningful progress in loan quality in 2024, closing the year with one of the lowest quarterly critical defect rates we’ve ever observed. However, continued volatility across the Legal/Regulatory/Compliance and Insurance categories, as well as within the Income/Employment Eligibility subcategory, highlights the importance of ongoing diligence in quality control efforts,” said Nick Volpe, Executive Vice President of ACES Quality Management.

In the quarter, the sub-categories of Documentation and Calculation/Analysis (under Income/Employment) saw declines. Eligibility-related defects increased in the Income/Employment, Assets and Credit categories. Documentation-related defects were up under the Assets category.

Purchase review share declined in Q4, with refinance review share up slightly. And, purchase defect share decreased, and refinance defect share rose a bit.

Conventional and FHA review shares were flat, and USDA and VA review shares were modest due to a low volume. FHA defect share declined, conventional defect share saw an uptick and VA defect share was flat.