Soft Spring Selling Season Takes a Toll on Builder Confidence

(Illustrations courtesy NAHB)

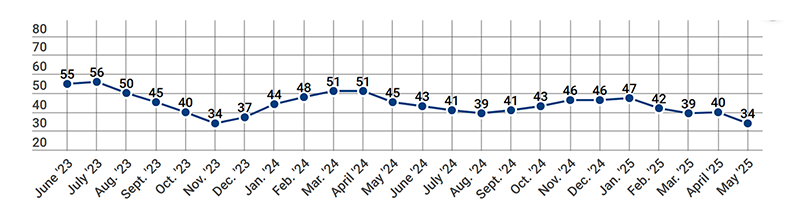

Builder confidence has fallen sharply on growing uncertainties stemming from elevated interest rates, building material cost uncertainty and the cloudy economic outlook, according to the NAHB/Wells Fargo Housing Market Index.

But the report noted that 90% of the responses received in May were tabulated prior to the May 12 announcement that the United States and China agreed to slash tariffs for 90 days to allow trade talks to continue.

Builder confidence in the market for newly built single-family homes was 34 in May, down six points from April. The figure is the lowest since the index hit 31 in December 2022.

“The spring home buying season has gotten off to a slow start as persistent elevated interest rates, policy uncertainty and building material cost factors hurt builder sentiment in May,” NAHB Chairman Buddy Hughes said. “However, the overwhelming majority of survey responses came before the tariff reduction announcement with China. Builders expect future trade negotiations and progress on tax policy will help stabilize the economic outlook and strengthen housing demand.”

The latest HMI survey also revealed that 34% of builders cut home prices in May, up from 29% in April and the highest level since December 2023 (36%). Meanwhile, the average price reduction was 5% in May, unchanged from the previous month. The use of sales incentives was 61% in May, the same rate as the previous month.

The NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor. All three of the major HMI indices posted losses in May.