MCT: Lock Volume Indices for April Stable

(Image courtesy of Vlada Karpovich/pexels.com)

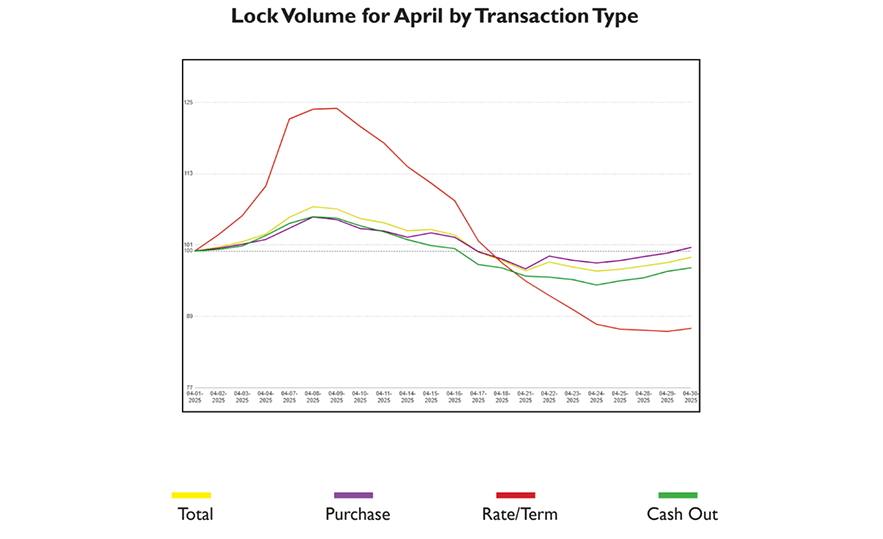

Mortgage Capital Trading, San Diego, released its latest Lock Volume Indices, showing little change in mortgage activity month-over-month. It recorded a 1.07% drop in all volume for April.

Purchase locks were essentially flat, up just 0.59%. The indices showed rate and term refinances were down 13.02% and cash out refinances were down 2.83%.

Year-over-year, the overall index was up 11.03%, with the purchase index up 2.9%, the rate and term refinance index up 196.19% and the cash out refinance index up 38.25%.

“These numbers are pretty much in line with what we anticipated going into May,” said Andrew Rhodes, Senior Director and Head of Trading at MCT. “Early April started strong with a brief dip in rates, but volatility returned by mid-month, pushing rates higher and muting new volume. It’s basic market behavior, but it’s being driven by an unusually high level of uncertainty right now.”

Rhodes said he anticipates summer origination volumes will stay pretty steady–as long as there aren’t any major economic shocks.

“Unless there’s a clear signal, like another quarter of negative GDP or sharp unemployment changes, we’ll likely continue to see this kind of tepid, sideways movement,” he said.