BofA: 60% of Homeowners, Prospective Buyers Uncertain About Housing Market

(Illustrations courtesy of Bank of America)

Uncertainty among current homeowners and prospective buyers has reached a three-year high, with 60% unsure whether now is a good time to buy a home, compared to 48% two years ago, Bank of America reported.

The latest Bank of America Homebuyer Insights Report also found that despite the uncertainty, 52% of prospective homebuyers are optimistic about the state of the homebuying market, saying it’s better now than it was a year ago. Three out of four said they expect home prices and interest rates to fall and are waiting until then to buy a new home, up from 62% in 2023.

“With so many factors impacting the homebuying market, prospective buyers and current homeowners are left wondering what it all means for them,” Bank of America Head of Consumer Lending Matt Vernon said. “A majority of buyers feel the market is headed in the right direction, but many are still planning to wait for more favorable conditions before they decide to take action.”

Gen Z Compromising in Order to Buy

The research found that despite financial hurdles, the dream of homeownership remains a powerful motivator for both Gen Z and Millennials, driving them to make sacrifices in the present and prioritize the long-term financial security a home can provide. For Gen Z and Millennials, three out of every four current homeowners say owning a home is a “milestone” achievement.

The 2025 data shows:

30% of Gen Z homeowners reported that they paid for their down payment by taking on an extra job, compared to 28% in 2024 and 24% in 2023.

22% of Gen Z homeowners reported they purchased their home with siblings, compared to 12% in 2024 and 4% in 2023.

34% of Gen Z prospective homebuyers would consider living with family or friends while waiting to purchase a home.

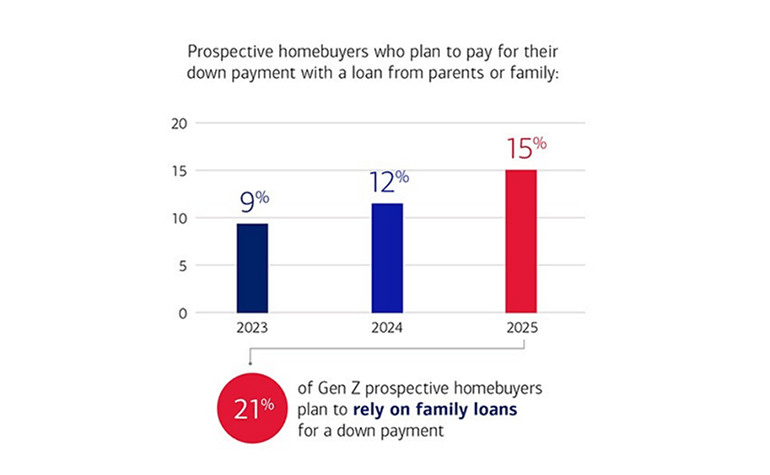

21% of Gen Z prospective homebuyers say they plan to pay for their down payment with a loan from parents or family, compared to just 15% of the general population who say the same. Among all prospective homebuyers, this number is up from 12% in 2024 and 9% in 2023.

“Even with the challenges they face, younger generations still understand the long-term value owning a home offers them and many are doing what it takes to get there,” Vernon said. “They are finding creative ways to afford down payments and working hard to improve their financial futures.”

Severe Weather ‘Top of Mind’ for Homebuyers

Nearly two-thirds of current homeowners and prospective buyers express concern about the impact of severe weather and natural disasters when it comes to homeownership, and 73% feel it is important to buy in areas where there is lower risk of these events occurring.

Many–38%–have changed their preferred home purchasing location due to the risk of severe weather in the area.

Among current homeowners, nearly a quarter have personally experienced property damage or loss in the last five years due to severe weather events.

65% of current homeowners are taking measures to prepare their home for the risk of severe weather, Bank of America found.