How Would a Recession Impact Existing-Home Sales?

Odeta Kushi is deputy chief economist at First American.

The housing market is entering one of its most critical seasons of the year, and all eyes are on the economy. With forecasters raising the alarm about an increased likelihood of recession, uncertainty is growing. In February, consumer sentiment soured and concerns about trade policy increased, putting downward pressure on the 10-year Treasury and, in turn, mortgage rates dipped. That drop in rates led to a slight pickup in the outlook for existing-home sales.

With so much economic uncertainty, many are wondering: how does the housing market typically respond during recessions?

How have Existing-Home Sales Fared During Recessions?

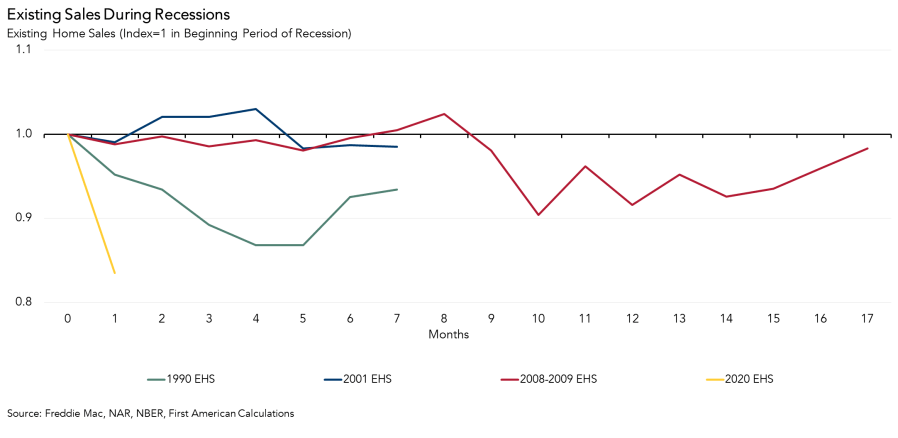

History tells us that a recession doesn’t automatically mean home sales will fall. In fact, in many past downturns, the housing market has remained surprisingly resilient. In the chart below, we show the impact on sales of the four most recent recessions. Each series is indexed to one at the start of a recession, such that the y-axis shows the magnitude of response in percentage terms relative to the start of the recession and the x-axis shows the duration. Looking at the last four recessions, we see varied impacts on existing-home sales. Some downturns had little to no negative effect, while others – especially when tied to housing – caused steeper declines.

• The COVID-19 recession (2020) led to an immediate drop in home sales due to economic shutdowns, but the decline was short-lived. The housing market rebounded quickly, fueled by record-low mortgage rates and strong demand.

• The early-aughts recession barely dented existing-home sales. In fact, just three months after it ended, sales hit a record high at the time, in part due to lower mortgage rates driven by Fed rate cuts.

• The Great Recession (2007-2009) was a different story. Because the housing market was at the center of the financial crisis, existing-home sales fell and took much more time to recover.

A recession alone doesn’t necessarily lead to a housing downturn. The housing market’s performance depends on the causes of the recession and how the Fed responds. When the economy slows, the Fed typically lowers interest rates to stimulate growth. As a result, mortgage rates often decline, improving affordability and boosting house-buying power. This dynamic was clear in past recessions where rate cuts encouraged home sales. Even amid economic uncertainty, lower borrowing costs can make homeownership more attractive, offsetting some of the recession’s negative effects.

What this Means for Today’s Uncertain Market

Every recession is different and predicting exactly when or how the next one will unfold is nearly impossible. However, history suggests that just because an economic downturn occurs, it doesn’t mean existing-home sales will collapse. The housing market is complex, shaped by a mix of economic, demographic, and monetary forces. While today’s housing market faces unique challenges—such as affordability constraints and inventory shortages—there are also strong underlying fundamentals, including pent-up demand and demographic shifts supporting homeownership. While recession fears loom, housing has proven resilient in past downturns. Rather than assuming a market crash, history suggests that lower mortgage rates could help support the housing market, just as they have in previous recessions.

February 2025 Existing-Home Sales Outlook Highlights

For the month of February, First American updated its Existing-Home Sales Outlook Report to show that:

• Existing-home sales for February are expected to increase 1.0 percent from January’s pace of sales, and increase 4.7 percent compared with the predicted pace of sales a year ago.

• The largest contributors to the projected monthly increase in existing-home sales are positive economic growth (+0.3 percentage points), an easing of the rate lock-in effect as measured by the lagged spread (the spread is incorporated with a two-month lag in the Existing-Home Sales Outlook model) between the prevailing market mortgage rate and the average rate for all outstanding mortgages (+0.2 percent), increased house-buying power (+0.1 percent), and improved credit conditions (+0.1 percentage points).

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)