Survey Finds Gaps in Americans’ Knowledge of Credit Scores

(Image courtesy of fauxels/pexels.com)

A new survey found that 24% of Americans haven’t checked their credit score in the past year.

The survey, conducted by All About Cookies, found that among the respondents who haven’t checked their credit score in the past year, 16% said they don’t know how.

In response to why they haven’t checked their score, 29% said they don’t want to pay for monitoring, 23% are worried that checking will hurt their score and 19% say they don’t have credit or a credit score.

Only 79% of Gen Z respondents say they know their score, the lowest of any generation. On the flip side, 92% of Baby Boomers say they do know their score. Equal portions of Gen X and Millennials (both at 88%) report knowing their scores.

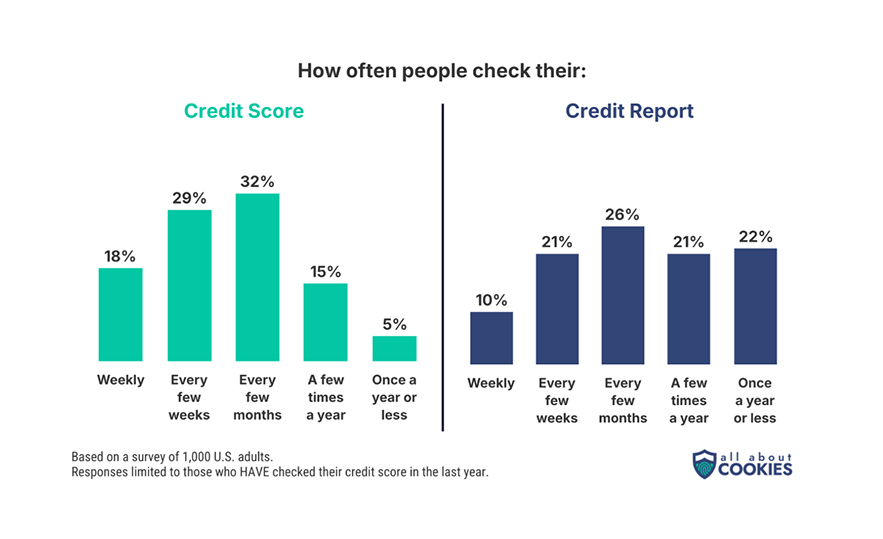

Among those who check their score, 18% say they look weekly, 29% say they look every few weeks, 32% say every few months and 15% say a few times a year or less. Only 5% say once a year or less.

However, fewer respondents check their credit report regularly, with only 10% saying weekly and 22% saying once a year or less.

In terms of what people use to monitor their credit, 72% say they use a free bank or credit card service, 26% say they use a free subscription from a previous breach and 22% say they use an annual free credit report. Smaller portions pointed to a paid monitoring service or credit counseling service.

And, only 9% of respondents could correctly identify every factor that go into a credit score–namely payment history, the amount of money owed on existing lines of credit, length of credit history, new credit lines opened and credit mix.