MCT Reports Stable Purchase Lock Volume Despite Market Pressures

(Illustration courtesy of MCT)

Mortgage Capital Trading, San Diego, found purchase lock volume was nearly flat compared to a month ago.

Amid elevated rates and continued uncertainty, the relative stability in purchase activity is a positive signal for the housing market, according to Andrew Rhodes, senior director and head of trading at MCT. “I view the consistency in purchase activity as a good thing,” he said. “Rates are still elevated, affordability remains a challenge, and yet we’re seeing steady demand. That tells me there’s still momentum in the market, even if it’s cautious.”

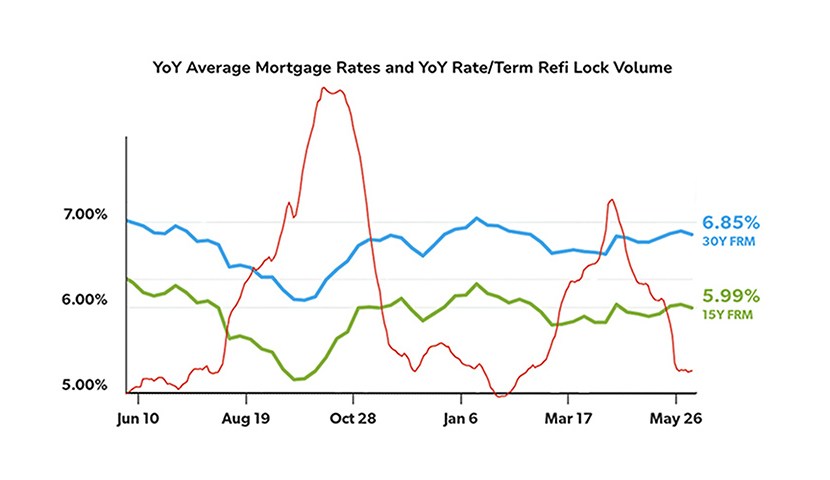

MCT reported overall lock volume declined -5.10% month-over-month, largely driven by a steep -44.76% drop in rate/term refinances. Cash-out refinance activity also slipped, down -7.77%.

Year-over-year, total volume dipped -2.03%, though rate/term refinance volume remains 31.11% higher than this time last year.

Rhodes attributes the volatility in refinance activity primarily to borrower sensitivity around rates. “The recent drop-off in refis tracks almost perfectly with where rates have gone,” he said. “A lot of that activity earlier this year was sparked by even slight declines in rates, but once inflation expectations shifted, especially with tariff headlines, that window closed quickly.”

Rhodes also noted that most borrowers still hold mortgages with lower rates than what’s currently available. “There just isn’t an economic advantage for most people to refinance right now,” he said.

Recent economic data has presented mixed signals. June’s Non-Farm Payroll report came in stronger than expected, but revisions to previous months have added uncertainty. Meanwhile, the Consumer Confidence Index rebounded in May to 98, about 11% above expectations, indicating a potential lift in sentiment.

“Consumer sentiment showed some resilience with that bounce in confidence,” Rhodes said. “It was a positive surprise, and that kind of momentum can support the market in the short term. But with inflation and rate pressures still looming, big financial decisions like buying a home or refinancing are harder to make when people aren’t sure what’s around the corner.”

Rhodes said he is watching a few indicators this summer. “Tariffs and inflation are front and center, especially with the Fed continuing to base its decisions on inflation and employment data,” he said. “There’s also talk of replacing the Fed Chair, which adds another layer of uncertainty. If these tariffs start to flow through and inflation proves stickier than expected, that could have a lasting impact on rate direction and market sentiment.”