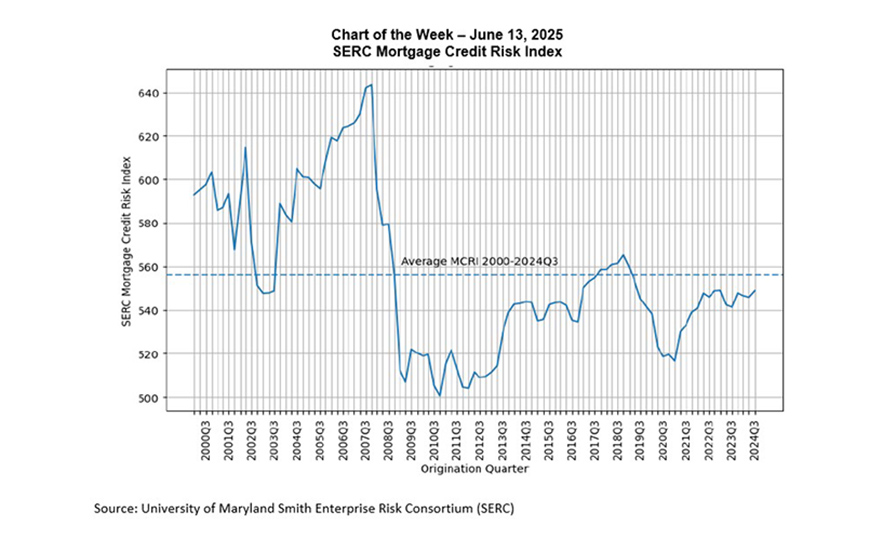

Chart of the Week: SERC Mortgage Credit Risk Index

An updated measure of GSE-eligible credit risk was recently released by the Smith Enterprise Risk Consortium (SERC) at the University of Maryland’s Robert H. Smith School of Business. The SERC Mortgage Credit Risk Index (MCRI) measures the default risk for loans aggregated and sold to Freddie Mac and Fannie Mae in each quarter. Higher index scores signify greater credit risk with every 40 points of MCRI score doubling the odds of default. The MCRI ranges between 300 and 900. For loans originated in the third quarter of 2024, credit risk of GSE-eligible mortgages remains relatively low with a SERC MCRI score of 549 compared with the long-term average SERC MCRI score of 556 (higher MCRI = higher credit risk).

Credit risk overall has deteriorated by about 30 score points since reaching a recent low in 2021Q1 but has remained stable in recent quarters. Year-over-year, credit risk rose by 7.5 MCRI score points due largely to other risk factors such as number of borrowers and fixed-rate loan terms.

The percentage of loans considered to be the highest credit risk according to SERC MRRI remained at historically low levels, suggesting limited evidence of excessive concentrations of adverse risk attributes among borrowers. Credit risk of loans sold by the largest GSE originators increased slightly while credit risk remained flat for other lenders in 2024Q3 relative to the previous quarter.

The MCRI will be worth watching in the coming months, as the recent increase in the MCRI is consistent with data from MBA’s National Delinquency Survey that showed the delinquency rate on conventional loans, most of which are GSE loans, moving slightly higher over the past year, at 2.7%. However, the delinquency rate is still significantly lower than the historical average of 3.7%. Given the close relationship between mortgage delinquency rates and the job market, and with signs of weaker economic and employment conditions in the near term, we expect delinquency rates to continue to drift higher over the next year.

To download a copy of the report and see other market data available to MBA members, please visit MBA’s website here. For more information on the SERC MCRI and MRRI indexes, please visit the SERC website.

Cliff Rossi (crossi@umd.edu); Mary Bittle Teer-Koenick (mbkoenic@umd.edu); Mike Fratantoni (mfratantoni@mba.org); Joel Kan (jkan@mba.org)