Colliers: Industrial Sector Slowing

(Illustrations courtesy of Colliers)

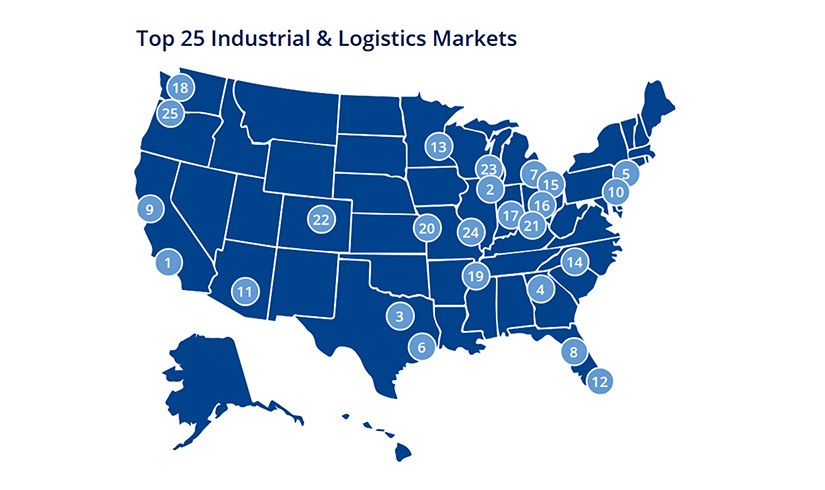

A shrinking construction pipeline for industrial properties has resulted in a 63% decrease in new supply over the past year in the country’s 25 largest industrial markets, according to Colliers, Toronto.

“As a result, vacancy has begun to rise more gradually, to an average of 6.9% in these markets, an increase of just 88 basis points year-over-year,” Colliers said in a new report, Markets That Move America.

Demand as measured by net absorption has also declined, totaling only 18 million square feet in the top 25 markets during the first quarter. “However, with new supply growth projected to decline more rapidly, these two indicators are expected to align by the end of the year, when vacancy could peak in most markets,” the report said. “Some markets where speculative construction was strongest, however, will take longer to recover from higher vacancy levels than those where balance has returned.”

Colliers noted construction starts have declined sharply, especially in the 25 largest markets. Total space under construction has dropped 61% since the cycle peak in late 2022. “While 68% of all construction, or 188 million square feet, was concentrated in these top markets as of Q1 2025, that figure is expected to decline further by year-end,” the report said.

Warehouse and distribution rent growth has slowed during the past four quarters after two and a half years where it exceeded 10%, Colliers reported. But overall rent growth is projected to remain positive in 2025, though below historical averages, the report said.

“Although economic volatility and trade policy uncertainty may slow leasing activity in the short term, industrial demand is expected to remain positive,” Colliers said. “Once vacancy rates peak, the market stabilizes, and economic conditions become clearer, a wave of pent-up demand will likely emerge, reducing vacancy and triggering the next phase of growth and development.”