CBRE: ‘Fragile’ Job Outlook for Life Sciences Jobs

(Image courtesy of Rodolfo Clix/pexels.com)

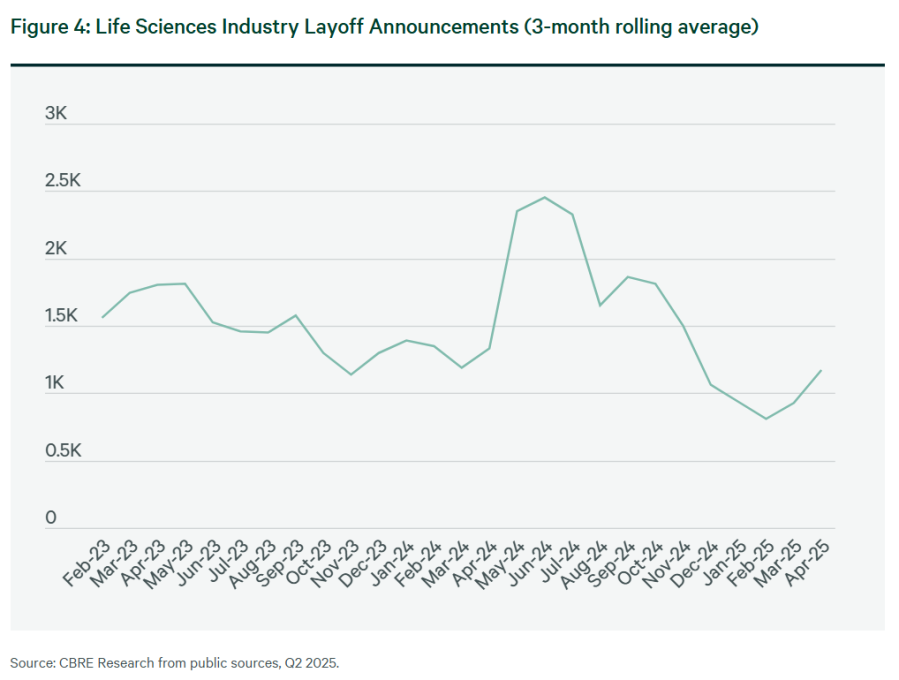

U.S. life sciences employment has wavered between small gains and declines since 2022 as the sector grappled with capital constraints and layoffs, leaving its growth prospects fragile this year, according to a new report from CBRE.

CBRE analyzed 100 U.S. life sciences markets in its 2025 Life Sciences Talent Trends report, updating its talent rankings of the top 25 markets in three subsectors: research and development, manufacturing and medtech.

The top ranking changed in two sectors this year with Boston-Cambridge surpassing New York-New Jersey for the top spot in life sciences manufacturing talent and Minneapolis-St. Paul surpassing Los Angeles-Orange County for the top ranking in medtech. In R&D talent, Boston-Cambridge retained the top spot.

Nationally, life sciences employment reached a record 2.1 million people in March but then posted a nearly 9,000-job decline (0.4%) in April. CBRE noted multiple factors have hindered the sector in the past three years, including falloffs in venture capital funding and initial public offerings, subsequent layoffs and, this year, cuts in federal research spending. The unemployment rate for life sciences professions nearly doubled in the past year to 3.1% in comparison to the overall U.S. rate of 3.9%.

“The underlying science of the life sciences sector–drug development–is strong,” said Matt Gardner, CBRE Americas Life Sciences Leader. “We’re dealing with a tough environment for funding, and the outlook for the sector’s job growth currently is fragile. But the foundation is in place for further growth once the sector’s challenges are surpassed.”

Meanwhile, the number of U.S. life sciences graduates has moderated. Year-over-year growth in U.S. biological and biomedical sciences degrees slowed from nearly 5% in the 2020-21 school year to 0.5% in 2022-23, the latest data available.

CBRE noted the sector has “more than enough space” to accommodate its workforce. Robust building in recent years contributed to the average vacancy rate climbing to 21.4% in this year’s first quarter from a recent low of 5% in the second quarter of 2022. “A decline in construction activity will provide some relief,” the report said. “In-progress construction fell to 8 million square feet in the first quarter from more than 35 million square feet two years prior.”