MCT: Rate/Term Refis Surge Nearly 10%; Purchase Activity Steadies

(Illustration: Jared VanderMeer/pexels.com)

Mortgage activity grew modestly across all categories in July, according to Mortgage Capital Trading, San Diego.

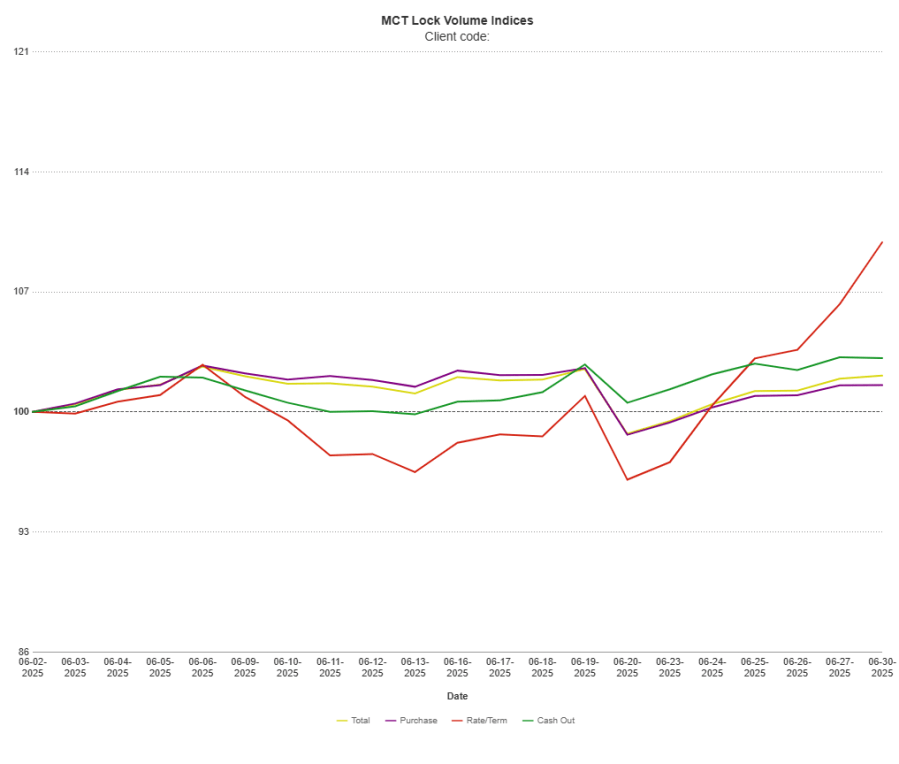

MCT reported total lock volume increased by 2.11% compared to June. Purchase lock volume rose by 1.56%, reflecting continued, albeit cautious, homebuyer demand. Rate/term refinance activity saw the most significant movement, surging 9.89% month-over-month, likely fueled by a dip in mortgage rates toward the end of June. Cash-out refinances also saw an uptick, increasing 3.14%, as homeowners continued to leverage equity despite economic uncertainty.

MCT’s July Lock Volume Indices said year-over-year growth was even more pronounced, with total volume up 9.39%, driven largely by a 35.49% increase in rate/term refinances and 24.41% growth in cash-out activity. Purchase locks were also up 7.04% compared to July 2024, signaling steady demand despite affordability and inventory challenges.

“The pickup in rate/term refinances were likely rate-driven,” said Andrew Rhodes, senior director and head of trading at MCT. “With a drop from the highs in rates toward the end of June, there was a direct effect on refinance activity. It’s a strong example of just how reactive this market continues to be.”

Rhodes noted that while refinance volumes remain volatile due to the relatively small population of eligible borrowers, purchase loans continue to anchor overall activity. “Rate-term and cash-out refinances may bounce around, but purchases are what’s driving the boat,” he explained.

Surprisingly, despite a stronger-than-expected jobs report ahead of the July 4th holiday with non-farm payroll coming in at 147,000, well above expectations of 110,000, markets remained calm.

“I was concerned that there’d be a lot more volatility in the markets, but it seems we’ve seen it trail off,” Rhodes said. “Coming out better than expected, with prior month revisions remaining steady, is a positive sign for the employment side of what the Fed is watching.”

Rhodes said inflation remains a concern. “And while we’ve seen improvement in GDP estimates for Q2, consumers are still unsure about what’s ahead,” he added.

Looking to the future, Rhodes acknowledged that the possibility of a Fed rate cut later this quarter could provide an additional boost to volume. However, volatility remains a key challenge for lenders.

“Our best-case scenario is a steady, moderate uptick in lock activity with range-bound rates. Volatility is the real killer when it comes to managing margins,” he said.