From Surviving to Transforming: Rethinking AI and Data Maturity in Mortgage Banking

Mark Dangelo is a regular contributor to MBA NewsLink.

In January the mortgage industry started out with great promise. In July, industry leaders, buyers, and sellers are still hoping that 2025 will usher in the market transformation anticipated after three years of low volumes and consumer sentiments.

Additionally, the hype and rapid pervasiveness of emerging technologies like AI have altered the discussions on investments in personnel, applications, compliance, and most importantly, data.

Not since the paper-to-digital conversion efforts that formed the genesis of financial and regulatory technology (i.e., FinTech and RegTech) has emerging technologies (e.g., Gen AI, RAG, Agentic AI, Agentic RAG) shaken the strategy and architecture developments of organizations regardless of size. However, herein resides both the challenge and opportunity—where should organizations invest their limited resources, focus their experienced personnel, and captivate the imagination and business and homeowners?

Setting the Table: First and foremost, AI is not a single application. It is a data-driven series of solutions that are adaptive to the data ingested and can create decision outputs which are “hallucinations” over time formed by what is termed “model drift.” Making this risk a high priority, and given historical application designs with data framed within designs (e.g., LOS, CRM), the development and rollout of AI represents a quantum shift in data—standards, sourcing, accuracy, auditability, and multimodality (i.e., structured, unstructured, synthetic).

AI for many is centered around Gen AI and its passive delivery of chatbots, customer portals, and next-gen business intelligence (using historical data artifacts for solutions like dashboards). Additionally, internal and vendor discussions are concentrated on AI engineering components—orchestration, LLM’s, SLM’s, vector databases, tokenization, embeddings, and prompt augmentation—rather than the complete lifecycle that is AI.

Encasing the AI rapid technological iterations, the takeaways for the remainder of 2025 include:

• Mortgage banking faces a host of challenges, requires flexible and scalable systems to deliver operational and regulatory consistency (not just compliance), which is not just a siloed AI implementation.

• While Gen AI excels for document parsing, chatbots, summarizations, it only can do this over time with active data architectures and governance.

• AI integration demands connecting all forms of data across systems (e.g., AVM, LOS, CRM, servicing) into “meshes” of both centralized and distributed sources.

• Organizations will need hybrid designs that put data first—process automation silos second—using domain specialization and ownership over one-size-fits-all IT.

• Without AI “stacks” of capabilities fully designed for integration and data sharing, AI will not scale, fail quickly, and produce inconsistent ROIs.

Why does all this matter? What are the next-gen risks and priorities created by a new patchwork of AI capabilities in an industry struggling to find it next prosperity curve? The answers to these and many more business and technology imperatives resides with understanding and preparing for more than AI’s engineering architecture.

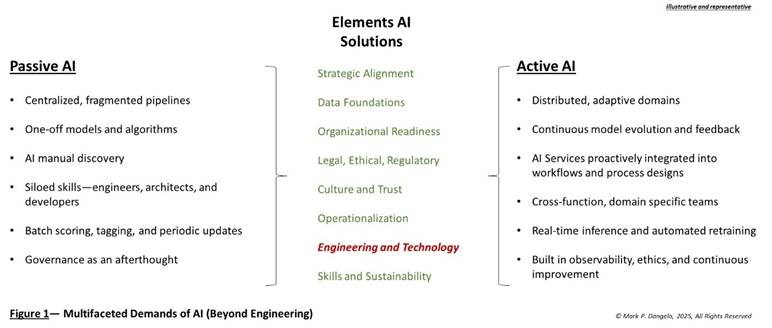

Figure 1 below illustrates an expansive set of elements of AI solutions profiled by passive versus active requirements for industry leaders seeking to the rapidly changing options with intelligent solutions.

Highlighted in the center of Figure 1 are the critical important AI ontologies that must be addressed as part of business and IT deployment of applications. It also showcases the differences of why AI is not just a single solution or one-off design, but a comprehensive integration of all enterprise data assets including external sources used via API’s, data warehouses, data marts, or even third-party data brokers.

What happens to an industry or enterprise that has inconsistent, inaccurate, and replicated data that is fed into data-driven AI solutions? Can the supply chain of data based on intelligent decisioning be traceable as active AI becomes increasingly the norm?

It’s NOT Singularly About AI: The mortgage industry has been enduring a grinding contraction of volume. Combined with rising negative sentiments surrounding interest rates, property taxes, insurances, and asset upkeep, homeownership for many buyers, including first-time buyers, has become a long-term goal (with new research showing that in 2025 ownership is twice as expensive as renting).

Therefore, to focus solely on the “magic” of AI as the means to greater margins, customer engagement, and profitability is a cause-effect quotient that will produce an “error” condition. The road to AI being actively integrated within the enterprise as part of the next-gen wave of transformation based on common, cross-system data demands a stringent review of how AI will be used across mortgage banking, its anticipated benefits, and the impacts and risks of not adopting an active AI corporate approach (i.e., more than engineering).

Table 1 below provides several use-case categories with representative components that are likely when moving from an industry embrace of passive AI to active AI for real-world functions.

Illustrative and Representative

| Use Case Category | AI Active Solution | Expected ROI / Benefits | Risks / Issues of non-Adoption |

| Loan Manufacturing | AI pre-underwriting and risk scoring Automated QC defect detection | Reduces underwriting time/cost by 30% with better loan quality Prevents costly buybacks and improves GSE relationships | Continued high manual costs with increased repurchase risks Persistent errors, non-salable loans, and reputational risks |

| Servicing and Retention | Early forbearance and default protection Refi and “churn” trigger detections | Up to 20% fewer delinquencies with improved portfolio performanceHigher CLV with better retention in a low-volume market | MSR value loss and high NPL servicing costs Lost Revenue opportunities combined with borrower attrition to competitors |

| Regulatory Compliance and Consistency | Realtime HMDA / Fair Lending analytics AI-powered document classification | Reduce audit risks and fine exposures 3x faster disclosures with improved transparency | Fines, sanctions, and increased scrutiny from regulatorsCompliance delays and higher manual costs |

| Operations and Cost Control | Appraisal review automation AI agents / chatbots with embedded reasoning | Cuts 3rd-party review costs with expedited decisions 40% call deflection in a 24/7 scale without linear staff increases | Slow run-times, rising vendor spending, and process bottlenecksCall center overload with inconsistent borrower support |

| Capital Markets | Loan pool stratification with bid pricing AIDynamic pricing algorithms | Improved sale process and accurate investor targetingRecapture 15 to 30 bps per loan in volatile conditions | Suboptimal trades and lower MSR / loan sale marginsMargin erosion and uncompetitive pricing |

Table 1—Active Use Cases, Benefits, and Risks of non-Adoption

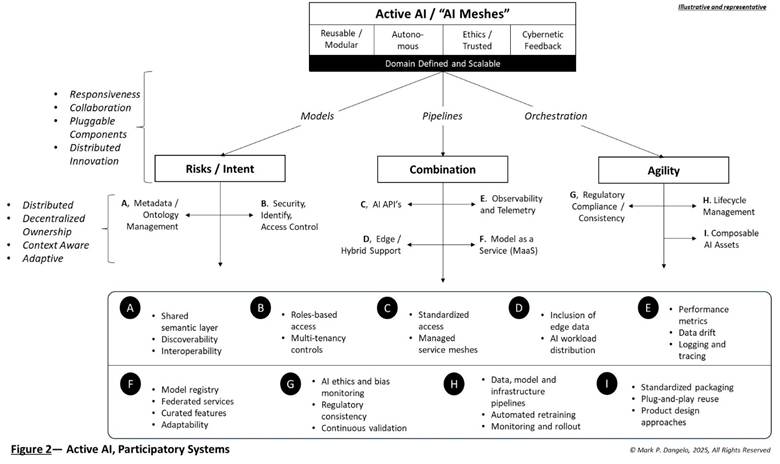

While we have shown the differences between AI passive and active designs (Figure 1) along with represented use cases (Table 1), the next step is to decompose the guidance into a blueprint where engineering solutions can be connected to the overarching framework. Figure 2 provides this representation and illustrates the segmentation or compartmentalization useful in creating active AI as vendors and development teams move from Gen AI into Agentic AI solutions.

Figure 2 conceptually wraps governance, observability, and workflow retaining into full domain intelligent agents delivered using building blocks of functionality that are interoperable and leverageable.

Active AI is progressively being referred to the creation of AI-as-a-Service (AIaaS) incorporating data-as-a-service (DaaS) and data-as-a-product (DaaP) designs. Moving forward, it is about designing and building solutions that are about value-creation rather than simple process efficiency.

Should industry leaders focus on AI engineering within processes? What are the risks across AI-to-AI interactions? How will intelligent, data-driven AI solutions react once trained to error filled inputs of operational or third-party data impacting their algorithms and self-retraining feedback loops?

Not Your “Fathers” Mortgage Industry: AI is not like the prior adoption of a FinTech or RegTech solution as these were often developed to deliver workflow automation and operating efficiencies all within siloed processes bridged by cumbersome and varied APIs. Now 20 years later, AI has exposed a new paradigm that requires advanced data designs and oversight before process automation (i.e., data over system ideation).

What is now evident as 2025 progresses, is that AI is moving so fast that the lifecycle of passive solutions delivered with great promise just 12 to 18 months ago are flawed. Whereas data transformation (i.e., manual to paper) using common standards was sold and delivered as a destination for the industry, in reality it was just a building block for today’s AI requirements, expansions, and oversight.

The winners for 2026 and beyond are now focused on more than passive AI approaches. The reality is that for mortgage banking, the embrace of active AI beyond the engineering will likely create new leaders and market-favored brands.

Those who fail to address the AI maturity that is accelerating from Gen AI to Agentic RAG will be the losers even with the hopeful potential of an M&A resurgence being a savior. Regardless of how much money is spent trying to integrate AI using non-AI (i.e., traditional design and development) methods, the cycles involving AI are completely different from the past and demand a rethinking of how active oversight and integration is implemented.

In the end, failing to capitalize on market slump(s) and technological chaos as a means to rethink and transform an industry “is a terrible thing to waste.” Afterall, AI is not a technology problem—it is a data design opportunity that mirrors the same challenges previously experienced by an industry undergoing a different chaotic event.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)