ATTOM: Foreclosure Activity in First-Half 2025 Increases From 2024

(Image courtesy of Erik Mclean/pexels.com)

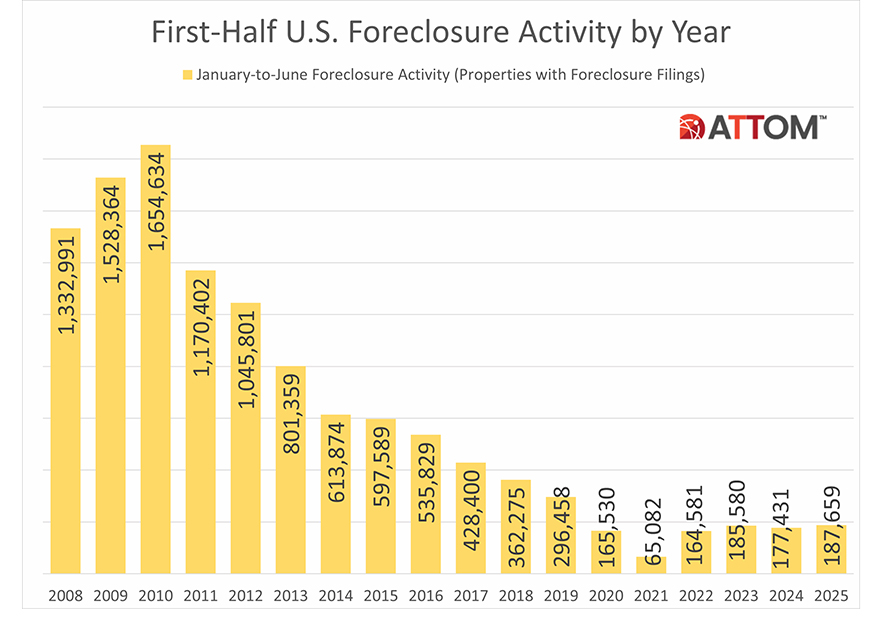

ATTOM, Irvine, Calif., found there were a total of 187,659 U.S. properties with a foreclosure filing in the first six months of this year–up 5.8% from the same period in 2024 and 1.1% from the same period in 2023.

ATTOM defines properties with foreclosure filings as those with default notices, scheduled auctions or bank repossessions.

“Foreclosure activity continued its upward trend in the first half of 2025, with increases in both starts and completed foreclosures compared to last year,” said Rob Barber, CEO at ATTOM. “While the overall numbers remain below pre-pandemic levels, the persistent rise suggests that some homeowners are still facing financial challenges amid today’s housing and economic landscape.”

There were 140,006 U.S. properties for which the foreclosure process was started in the first six months of the year. That’s up 7% from this period last year and up 41% from partially pre-pandemic first-half 2020.

Lenders foreclosed on 21,007 homes from January-June this year, up 12% from the first half of 2024, but down 7% from first-half 2023.

Properties foreclosed in the second quarter had been in the foreclosure process for an average 645 days, down 4% from Q1 and down 21% year-over-year.

Nationwide, 0.13% of all housing units had a foreclosure filing. By state, the highest rates were seen in Illinois (0.23% of all housing units), Delaware (0.23% of all housing units); Nevada (0.21% of all housing units); Florida (0.21% of all housing units) and South Carolina (0.2% of all housing units).