JLL: Policy Volatility Reshaping U.S. Construction Landscape

(Image courtesy of Allen Boguslavsky/pexels.com)

Policy uncertainty is creating both challenges and opportunities in the U.S. construction industry, according to JLL, Chicago.

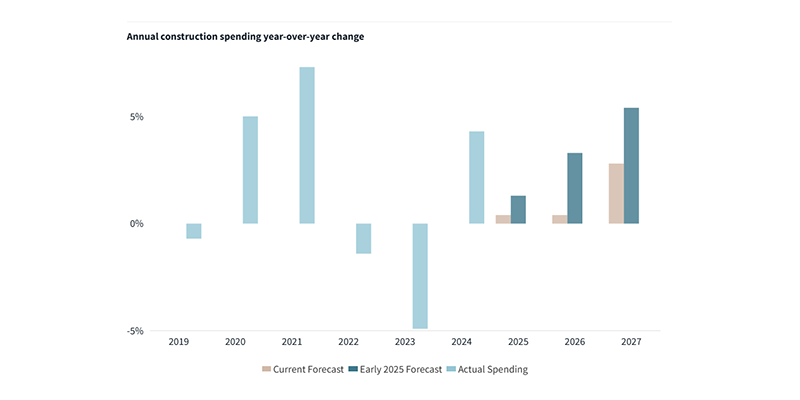

JLL’s new Construction Perspective: U.S. Mid-year Update noted some bright spots, but says the U.S. construction industry faces a challenging outlook with projects increasingly on hold, spending forecasts adjusted downward and contractors facing reductions in secured work. Current forecasts anticipate real construction spending growth to hold at its lowest point since the pandemic through 2026.

“The construction industry is experiencing uncertainty that is affecting everything from material costs to labor availability,” JLL Head of Project and Development Services Louis Molinini said. “Despite these challenges, we’re seeing remarkable resilience in select sectors and regions that remain extremely active. It’s a local game that rewards strategic capital planning more than ever.”

The report found “uneven” development dynamics. “Public investments continue to disproportionately reshape both the economy and construction landscape, with private investment responding unevenly as investors assess changing priorities and funding support,” JLL said. “With federal funding being redirected, data centers nevertheless continue to expand at an incredible pace, looking to more than double real spending from 2023 to 2026.”

The cost environment has shifted dramatically in the last few months, transitioning from modest contraction to potentially one of the largest increases in recent history, JLL said. “Overall cost growth forecasts now sit in a 7-12% for 2025,” the report said. “Reliance on imported materials is not even, with goods critical to data centers and advanced manufacturing facing particularly high exposure across their supply chains. Delays and renegotiations have pushed back the impacts of tariffs and increases will emerge more fully over the back half of this year and into 2026.”

The construction industry faces “unprecedented” pressure from immigration policy, with the anticipated growth rate down to just 1%, well below the 3% average rate of the past few years, the report said.

“With activity currently slowed, the full effects of lower labor growth won’t be clear right away,” said Andrew Volz, Research Manager, Project and Development Services with JLL. “As we ramp up demand in 2026, however, the extent of the disruption will become readily apparent. Labor retention and development will remain the primary concern of forward-looking contractors, regardless of current backlogs.”

Molinini noted strategic adaptation and flexibility will be important over the next 12 months. “Understanding that project exposures aren’t equal and local factors matter most for project outcomes is essential for success in today’s environment,” he said.