Share of Mortgage Loans in Forbearance Decreases Slightly to 0.47% in December

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 3 basis points from 0.50% of servicers’ portfolio volume in the prior month to 0.47% as of Dec. 31, 2024. According to MBA’s estimate, 235,000 homeowners are in forbearance plans.

Mortgage servicers have provided forbearance to approximately 8.5 million borrowers since March 2020.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 basis points to 0.19% in December 2024. Ginnie Mae loans in forbearance decreased by 4 basis points to 1.07%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 2 basis points to 0.40%.

“The overall mortgage forbearance rate decreased slightly in December as some borrowers got back on track following last fall’s severe weather in the Southeast,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Even with the slight decrease, the level of forbearance is higher than it was six months ago across all loan types and the performance of servicing portfolios and loan workouts has weakened.”

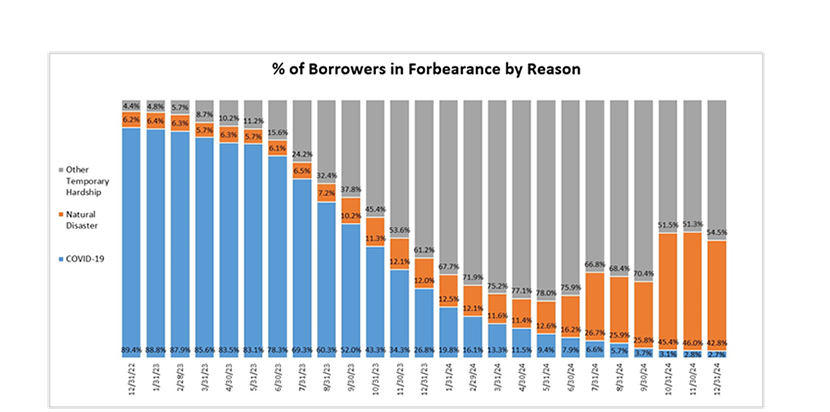

Added Walsh, “At year end, almost 43% of borrowers in forbearance were there due to a natural disaster. Given the disruption and devastation caused by the California wildfires, that share will likely move higher in the months ahead, as homeowners turn to forbearance to allow time to navigate their recovery process.”

Key Findings of MBA’s Loan Monitoring Survey – December 1 to December 31, 2024

• Total loans in forbearance decreased by 3 basis points in December 2024 relative to November 2024: from 0.50% to 0.47%.

• By investor type, the share of Ginnie Mae loans in forbearance decreased relative to the prior month from 1.11% to 1.07%.The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior month from 0.21% to 0.19%.

• The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased relative to the prior month from 0.42% to 0.40%.

• Loans in forbearance as a share of servicing portfolio volume (#) as of December 31, 2024:

• Total: 0.47% (previous month: 0.50%)Independent Mortgage Banks (IMBs): 0.54% (previous month: 0.58%)

• Depositories: 0.38% (previous month: 0.39%)

• By reason, 54.5% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability. Another 42.8% are in forbearance because of a natural disaster. Less than 2.7% of borrowers are still in forbearance because of COVID-19.

• By stage, 70.5% of total loans in forbearance are in the initial forbearance plan stage, while 16.8% are in a forbearance extension. The remaining 12.7% are forbearance re-entries, including re-entries with extensions.

• Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) was 95.05% in December 2024, down 17 basis points from 95.22% the prior month (on a non-seasonally adjusted basis), and down 39 basis points from one year ago.

• The five states with the highest share of loans that were current as a percent of servicing portfolio: Washington, Idaho, Alaska, Oregon, and Colorado.

• The five states with the lowest share of loans that were current as a percent of servicing portfolio: Alabama, West Virginia, Indiana, Mississippi and Louisiana.

• Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts decreased to 65.39% in December 2024, down 88 basis points from 66.27% the prior month and down 900 basis points from one year ago.

MBA’s monthly Loan Monitoring Survey covers the period from December 1 through December 31, 2024, and represents 62% of the first-mortgage servicing market (30.8 million loans). To subscribe to the full report, go to www.mba.org/loanmonitoring.

NOTES:

• MBA’s disaster recovery resource guide contains important information for affected homeowners, including what to do immediately after a disaster, starting with contacting their mortgage servicer, homeowners insurance company, and applying for disaster assistance with the Federal Emergency Management Agency.

• For more detailed information on performance metrics, including seasonally adjusted delinquency rates by stage (30 days, 60 days, 90+ days), please refer to MBA’s Quarterly National Delinquency Survey at www.mba.org/nds. Fourth-quarter 2024 results will be released on Thursday, February 6, 2025.

The next publication of the Monthly Loan Monitoring Survey will be released on Tuesday, Febr. 18, 2025.