Home Price Growth Reaccelerates in Fourth Quarter, Fannie Mae Reports

(Illustration courtesy of Fannie Mae)

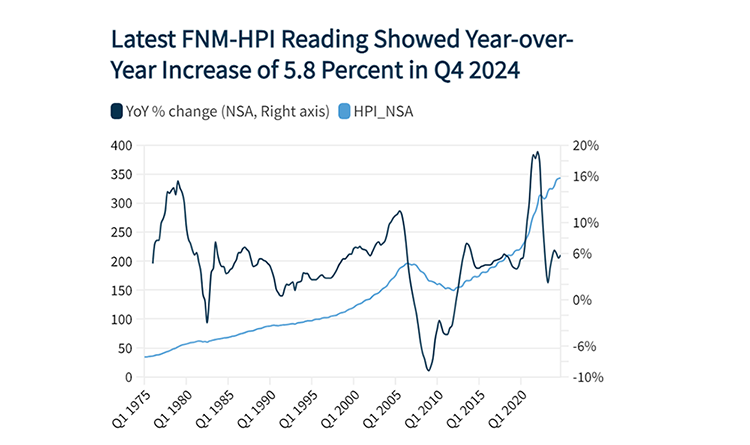

Single-family home prices increased 5.8% between late 2023 and late 2024, an acceleration from the previous quarter’s 5.4%, according to the Fannie Mae Home Price Index.

The FNM-HPI is a national, repeat-transaction home price index that measures the average quarterly price change for all single-family properties in the United States, excluding condos.

On a quarterly basis, home prices rose a seasonally adjusted 1.7% in the fourth quarter, up from the downwardly revised 1.2% growth rate in third-quarter 2024. On a non-seasonally adjusted basis, home prices increased just 0.3% in the fourth quarter, the report said.

“Year-over-year home price growth accelerated in the fourth quarter, following back-to-back quarters of deceleration,” Fannie Mae Senior Vice President and Chief Economist Mark Palim said. “Inventories of existing homes for sale have improved from a year ago but remain historically low, due largely to the so-called ‘lock-in effect.’ Since the beginning of October, mortgage rates have rebounded after bottoming out around 6.1% and are now inching closer to a new psychological barrier, the 7% threshold.”

Palim noted that the higher mortgage rate environment not only hurts affordability, but is also exacerbating the lock-in effect by further reducing homeowners’ incentive to move.

“The housing market in 2025 faces a difficult balancing act, with a notable decline in mortgage rates likely needed to help unwind the lock-in effect and thaw the supply of existing homes for sale,” Palim said. “However, we believe such a decline would likely jumpstart demand from potential first-time homebuyers currently waiting to purchase, which could lead demand to outpace any improvement in supply, further exacerbating already-high home prices and purchase affordability.”