Matic: Premium Growth Slowing, but Insurance Affordability Challenges Remain

(Image courtesy of Tom Fisk/pexels.com)

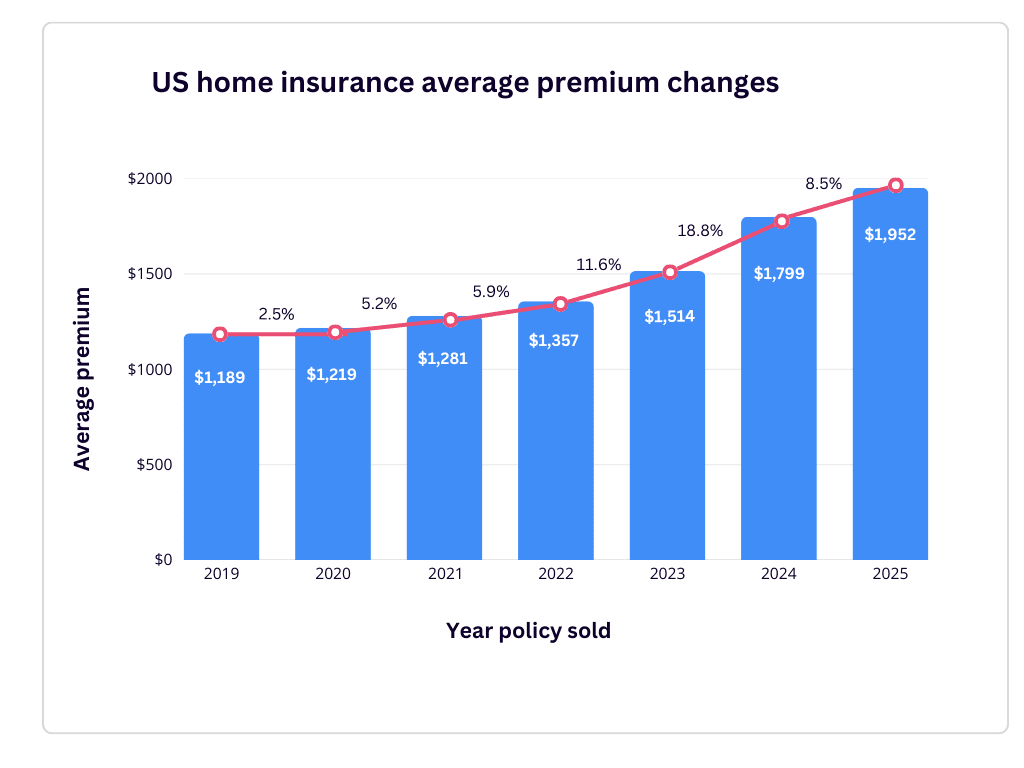

Matic, Columbus, Ohio, reported that after a few years of significant rate increases, home insurance premium growth began to slow in 2025.

As of December, Matic data shows the average premium for a new policy reached $1,952, up 8.5% year-over-year. That’s a significant drop from the 18% growth in 2024 and 12% in 2023.

That said, growth generally averaged 3-5% before 2022, and premiums are still at an all-time high.

Insurance is estimated to account for an all-time high of 9% of the typical homeowner’s monthly mortgage payment.

The average deductible rose 22% this year, up from 15% in 2024.

One notable trend: Insurance carriers are becoming more granular in assessing property-specific risk. For example, roof age has emerged as an influential factor in underwriting, with roof claims costs reaching $31 billion in 2024. The premium gap for homes with newer roofs and those 11-15 years old continues to widen. The difference in 2022 was $49. In 2025, the difference was $155.

Home insurance costs continue to vary widely by state, Matic reported. Georgia saw the largest increase in premium costs last year, at 28.4%, followed by Colorado at 25.7%, New York at 23%, Texas at 20.5% and Mississippi at 19.4%.

Access to home insurance did begin to improve in 2025, as more carriers returned to profitability. By December, the number of quotes per person had risen 78% from the low point notched in 2024.

Looking forward to 2026, Matic predicts climate and catastrophe risk will continue to play a big role. 2025 was the first year in a decade without a major U.S. hurricane landfall, but a large catastrophic event moving forward could affect many corners of the market.

2025 did see convective storms in the Midwest and Southeast, causing (as of September) $42 billion in insured losses. And, 87% of insurance executives say they have significant or moderate concern about future losses from such storms.

High insurance costs will likely persist, the report said, and may push more conversations around consumer protections and reform.

AI and advanced technology will continue to play a central role in home insurance, with carriers expanding their use of such technologies.

And, proactive risk management will be a focus in the new year, Matic predicts.