AD Mortgage Finds Industry Optimism

(Cover illustration courtesy of Johnson via Unsplash)

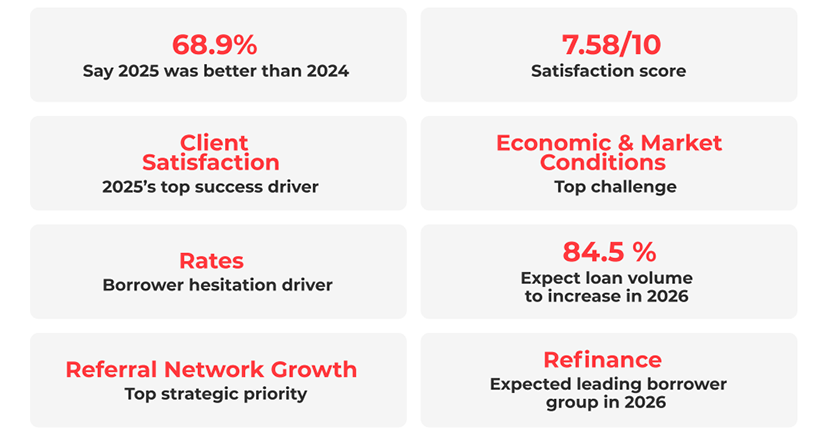

Nearly 70% of mortgage professionals surveyed by AD Mortgage, Fort Lauderdale, Fla., said 2025 was a better year for business than 2024.

Many were also optimistic about the year ahead, with 57.6% saying they felt motivated for 2026, according to AD’s Mortgage Professionals Pulse Report & 2026 Outlook.

Most survey respondents said they expect business to grow next year (84.5%), citing the strengthening of referral networks (38.5%), the expansion of Non-QM offerings (30.4%) and an improvement in borrower experience (11.7%) as key factors that will drive growth in the year ahead.

The most significant obstacles in 2025 were external, with 67.8% of those surveyed citing broad economic and market conditions and 43.5% pointing to rate volatility. Client acquisition challenges were noted by 31.4%, whereas internal or operational factors such as tools or regulatory shifts played a far smaller role.

Most respondents said borrower hesitation was driven overwhelmingly by interest rates; 59.7% selected rates as the main reason clients didn’t move forward. Home prices were the second-most-cited barrier at 27.9%, while credit concerns made up just 7.1% of responses.

AD Mortgage surveyed more than 300 professionals across the country in late November and early December to prepare the report.