Unemployment Rate Rises; Industry Economists Weigh in on Latest Jobs Data

(Image courtesy of Josh Sorenson/pexels.com)

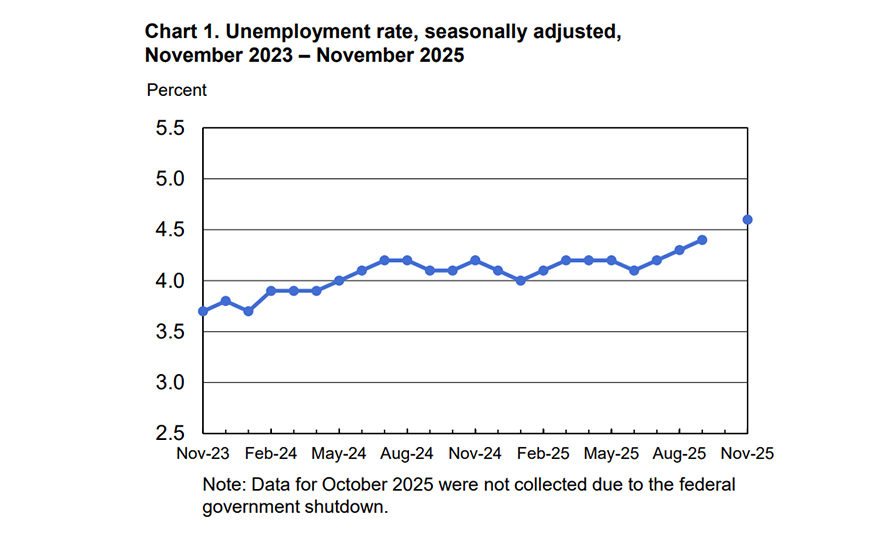

The delayed report released Dec. 16 by the Bureau of Labor Statistics showed 64,000 jobs were added in November, with the unemployment rate up slightly to 4.6%.

The release was delayed until mid-month by a lapse in federal appropriations during the government shutdown. In addition to the report, BLS released an abbreviated October account that showed jobs down by 105,000.

Employment rose in health care and construction and continued to fall in the federal government.

The change in total nonfarm payroll employment for August was revised down by 22,000, from a loss of 4,000 jobs to a loss of 26,000. It was revised down by 11,000 for September, from 119,000 to 108,000.

“The net is that the job market is softening more rapidly than markets had anticipated, but in line with MBA’s forecast,” noted MBA SVP and Chief Economist Mike Fratantoni. “The job losses in October were largely due to a decline of a 162,000-loss in federal government employment under the deferred resignation program. So far this year, federal government employment is down by 271,000. Employment figures for August and September were revised down a combined 33,000 with this release.”

“The most significant news from this report was the increase in the unemployment rate to 4.6% in November from 4.4% in September, noting that there will not be an estimate for October,” Fratantoni continued. “The number of unemployed individuals increased from 7.6 million in September to 7.8 million in November. Beyond this, underemployment spiked. The U6 jumped from 8.0 in September to 8.7 in November. 5.5 million people are working part-time but would prefer a full-time job. This category increased by 909,000 from September to November and is one of the drivers of the U6 increase.”

“Despite the November payrolls upside surprise, the increase in unemployment is likely to keep the Federal Reserve’s attention on labor-market risks, especially after delivering a series of quarter-point cuts since September. While today’s report may strengthen the case for additional cuts early next year, Thursday’s inflation data and December’s jobs report–both arriving before the next FOMC meeting–will carry greater weight in shaping policy decisions,” said First American Senior Economist Sam Williamson.

“For housing, mortgage rates are likely to stay near current levels around one-year lows, offering a relatively stable backdrop that may coax more buyers off the sidelines. Even so, for many households, life events–not marginal rate moves–will remain the main catalyst for buying decisions for the time being,” Williamson stated.