MCT: Refinance Volume Exceeds Expectations in August

(Stock photo courtesy of Jared VanderMeer/pexels.com)

Mortgage Capital Trading, San Diego, said its Lock Volume Indices report showed modest decline in overall activity in July. But refinance segments outperformed expectations despite continued uncertainty in the housing market.

“Rate/term and cash-out refinances are still moving, which is surprising given current rates,” MCT Director of Trading Andrew Rhodes said. “But for cash-outs in particular, it feels more like a necessity than a luxury.”

Rhodes said people may be pulling equity to consolidate debt or cover expenses, “not because it’s the optimal time to borrow.”

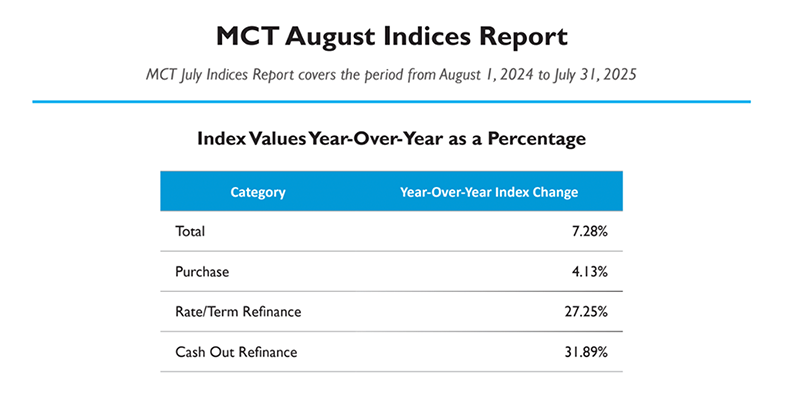

According to MCT’s data, total lock volume fell 6.51% month-over-month, driven by an 8.03% decline in purchase activity. However, rate/term refinances increased by 5.38%, while cash-out refinances remained virtually flat, rising just 0.48%. Year-over-year trends continued to show strength: total volume rose 7.28%, with rate/term refinances up 27.25% and cash-out refinances up 31.89%. Purchase activity held onto a 4.13% year-over-year increase, as this month’s purchase volume slowdown likely reflects seasonality in the market.