ICE Mortgage Monitor: Originations Hit Highest Quarterly Volume Since 2022

(Image courtesy of Curtis Adams/pexels.com)

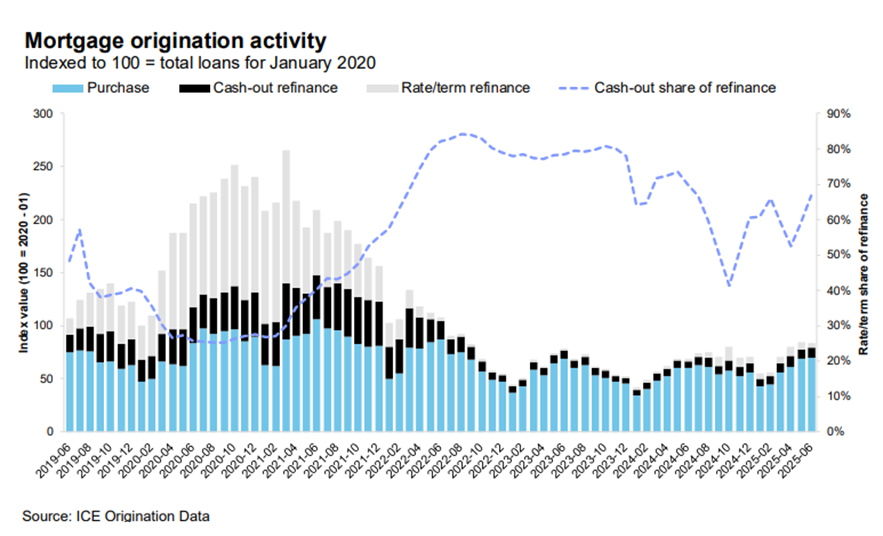

ICE Mortgage Technology, Atlanta, released its latest Mortgage Monitor report, finding that mortgage originations saw their highest quarterly volume in Q2 since 2022.

Both purchase and cash-out refinance activity were near three-year highs. Total and tappable home equity volumes are also the highest on record.

“Homeowners are actively drawing on record equity with cash-out refinance loans, signaling increased demand despite elevated rates,” said Andy Walden, head of mortgage and housing market research at ICE. “Meanwhile, a substantial cohort of people who purchased homes over the last three years are watching on the sidelines for rates to drop so they can refinance into a lower monthly payment.”

Cash-out refinances accounted for 59% of all refinances in the second quarter–although ICE noted that 70% of those borrowers accepted higher interest rates (on average, a 1.45 percentage point increase) in order to tap their equity. They saw their monthly payments on average increase by $590, and tended to have lower average credit scores and smaller balances than rate-and-term refinancers.

ICE also noted that retaining cash-out borrowers was a challenge for mortgage servicers in the quarter. Overall refinance retention fell to 23%, the lowest since Q2 2024.

Home equity hit a record high in Q2–borrowers at the end of the period had a notable $17.8 trillion in equity, with $11.6 trillion in tappable equity. About 48 million mortgage holders had tappable equity; the average homeowner had $213,000 in accessible value.

However, slowing home price growth is slowing home equity growth as well–the pace has fallen to its lowest rate in two years.